Consumer Companies: Strategic Priorities for 2026

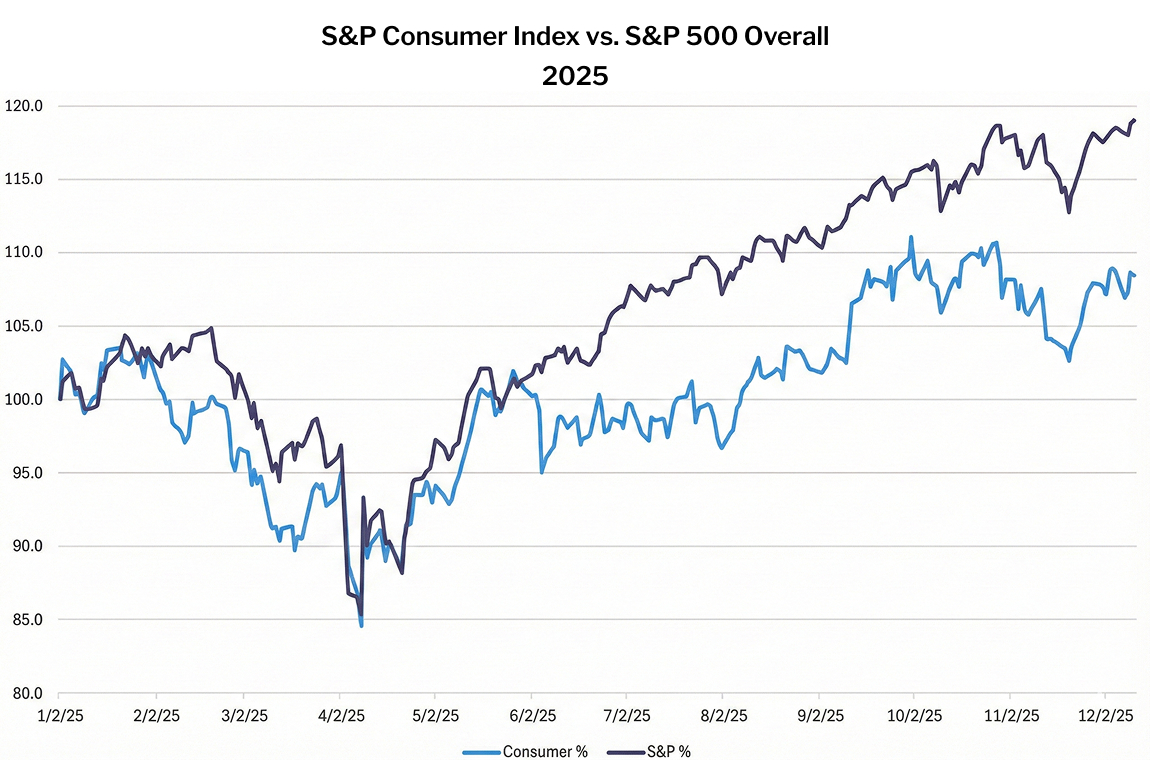

2025 was a mixed year for consumer companies. While a subset of brands managed to outperform, many others struggled to generate consistent growth. In aggregate, the S&P Consumer Index underperformed the broader S&P 500 by more than 10% in 2025, reflecting investor skepticism toward the sector relative to faster-growing alternatives.

Several structural pressures continue to weigh on performance. Persistent inflation has driven higher input and supply chain costs. At the same time, cautious consumer spending—particularly among middle-income households—has constrained growth across many core categories. Volume growth has largely stagnated, with reported revenue gains coming primarily from modest pricing actions and mix improvements, rather than true demand expansion.

These dynamics have put pressure on margins, slowed top-line growth, and ultimately impacted CPG valuations, as investors have shifted capital toward sectors with clearer growth trajectories and stronger secular tailwinds.

Periods like this demand clarity and discipline. For consumer companies, success will not come from chasing every trend but from adjusting strategies while doubling down on the core principles that have historically driven durable value creation.

Below are the top strategic priorities I see emerging for consumer companies in 2026 and beyond.

1. Drive profitable and sustainable growth

Growth remains the top mandate, but its definition has evolved. Winning companies are prioritizing profitable, sustainable expansion over volume at any cost.

First, companies must continue to expand market share. This can be achieved by:

- Increasing penetration within existing categories

- Expanding into adjacent categories where brand permission already exists

- Entering new geographic markets with disciplined localization strategies

Second, companies must increase revenue per customer. Key levers include:

- Product premiumization and tiered offerings

- Portfolio optimization—eliminating low-velocity, low-margin SKUs

- Channel expansion, including direct-to-consumer and specialty retail

In addition, companies need to consider how they reach customers. Omnichannel execution is no longer optional. Leading companies are asking:

- How do we seamlessly sell to and service customers across physical, digital, and hybrid channels?

- How can e-commerce and DTC improve margin structure and consumer insight, not just revenue?

- How do we proactively manage channel conflict while preserving retailer relationships?

Collectively, these efforts must translate into margin expansion. That requires:

- Advanced pricing and revenue growth management (RGM)

- More effective trade promotion spend and promotional ROI measurement

- Strategic sourcing and deeper supplier partnership programs to offset cost inflation

2. Strengthen brand equity and consumer connection

Data has become one of the most powerful assets in the consumer ecosystem—not simply because of its availability but because of the ability to convert data into actionable insight. Nowhere is this more critical than in strengthening brand equity and consumer connection.

First, consumer companies must deepen consumer understanding. This means:

- Leveraging real-time consumer data and advanced analytics

- Using social listening and sentiment analysis to detect emerging needs

- Rapidly testing, learning, and scaling innovation through agile experimentation

Second, brands must deliver compelling, consistent experiences. Winning companies are:

- Anchoring brands in authentic, purpose-driven narratives

- Delivering cohesive messaging across digital, social, in-store, and experiential touchpoints

- Measuring brand impact continuously and adjusting quickly based on performance data

Third—and this is increasingly decisive—is personalization at scale. This includes:

- Tailoring products, promotions, and content to specific consumer segments

- Using AI-driven recommendation engines across DTC platforms and retail media networks

- Moving from mass marketing to individualized engagement

3. Accelerate innovation and product differentiation

In a low-growth environment, speed and relevance in new product development matter more than ever.

Leading consumer companies are redesigning their innovation engines to prioritize:

- Faster speed-to-market through agile development processes

- Rapid prototyping and small-batch market testing

- Clear decision rights to scale or exit innovations quickly

They are also focused on product pipeline health as a critical discipline. This includes:

- Continuous renovation of core products to maintain relevance

- White-space innovation in adjacent or emerging categories

- New benefit platforms, packaging formats, or usage occasions

Companies leaning into science- and data-led innovation are able to leverage those developments as key differentiators. Advances in:

- Ingredient technology

- Functional and health-oriented benefits

- Sustainability-linked product features

are increasingly central to winning consumer preference and commanding premium pricing.

4. Build a resilient, efficient, and sustainable supply chain

Supply chains are no longer viewed solely as cost centers. When built effectively, they are strategic assets.

Top priorities for supply chain improvement include:

- End-to-end efficiency through improved demand forecasting, inventory optimization, and manufacturing automation

- Enhanced resilience via diversified supplier bases and regionalized (“near-shored”) production

- Real-time visibility tools that improve responsiveness and reduce disruption risk

With increasing regulatory pressure and consumer demand, sustainability must be embedded in supply chain strategy, not simply bolted on. Leading companies are making:

- Credible commitments to carbon reduction

- Investments in responsible sourcing and traceability

- Progress toward circular packaging and waste-reduction initiatives

Done correctly, sustainability strengthens resilience, reduces long-term risk, and builds brand trust.

5. Win in a digital-first commerce landscape

Digital commerce is no longer a differentiator—it is table stakes. However, excellence in execution still separates leaders from laggards.

This starts with true omnichannel integration, including:

- Unified retail and e-commerce strategies

- Portfolios and packaging optimized for digital fulfillment

- Seamless consumer experiences across channels

Leaders must integrate revenue growth management as a core capability, including:

- Dynamic and elastic pricing models

- Personalized promotions

- Retail media optimization across major platforms

Equally important is deepening retail partnerships through:

- Joint business planning

- Data sharing and category leadership

- Improved on-shelf availability and execution excellence

6. Strengthen organization, talent, and culture

Peter Drucker’s observation that “culture eats strategy for breakfast” remains as true today as ever. However, the lens through which organizations view talent and culture has evolved.

Modern consumer companies need the talent, tools, and organizational structures required to meet the challenges above. To prepare, they must:

- Invest aggressively in digital, analytics, AI, and e-commerce upskilling

- Embed digital tools and data-driven decision-making across functions

- Redesign operating models to enable speed and accountability

Agility is critical in addressing current initiatives and preparing for the future. Leading organizations are implementing:

- Faster decision-making processes

- Cross-functional squads for innovation and execution

- Clear P&L ownership and performance accountability

At the same time, purpose matters. Winning companies align teams around:

- Sustainability and social impact

- Diversity, equity, and inclusion

- Community engagement and long-term value creation

7. Cultivate ESG and regulatory excellence

Consumers, retailers, and investors increasingly expect companies to demonstrate responsible growth.

Meeting evolving regulatory requirements is non-negotiable, particularly in areas such as:

- Packaging and recycling mandates

- Ingredient transparency and labeling

- Emissions measurement and reporting

Leading companies go further, using ESG as a competitive advantage, not a compliance exercise. When executed authentically, ESG strengthens trust, improves retailer relationships, and enhances long-term shareholder value.

From strategic clarity to market outperformance

The consumer sector’s challenges in 2026 are real, but so are the opportunities. Companies that remain focused, disciplined, and consumer-centric will emerge stronger and capture market share. Success will belong to the leaders who move beyond reactive cost-cutting to embrace a proactive, data-led, and purpose-driven strategy. By aligning execution and culture around these seven priorities, consumer companies can transform today’s headwinds into tomorrow’s tailwinds.

Need help achieving your 2026 goals?

Get in touch with our teamMeet the Author

Gregg Clark is Managing Director, Consumer at Catalant, leading the company’s consumer business and bringing the value of Consulting 2.0 to consumer and retail companies. He also acts as faculty for the Institute for Mergers, Acquisitions and Alliances, a global not-for-profit M&A think tank and educational provider. Prior to joining Catalant, Gregg held senior management positions leading consumer strategy at EY, Accenture, and Capgemini, and he led Serenity Strategy, an independent consulting firm supporting leading enterprises through business strategy, digital transformation, advanced analytics, and M&A strategy and execution, for nearly 10 years. Gregg holds a Bachelor of Science in Electrical Engineering/Industrial Management from Purdue University.