introduction

The New Operating Reality

Private equity Operating Partners are navigating a business landscape defined by volatility, technological disruption, and mounting pressure to create measurable value on a rapid timeline.

With longer average holding periods and a growing emphasis on value creation through operational improvements, the traditional playbook of financial engineering and quick exits no longer delivers target returns.

Today’s Operating Partners must orchestrate complex operational transformations across expanding portfolios while managing:

- Need for accelerated value creation to achieve target IRRs

- Resource constraints from LP-mandated operational budgets

- Talent scarcity in critical functional areas like digital transformation and commercial excellence

- Exit pressure with mounting unrealized value across portfolios

While leveraging external expertise for transformation, value creation, and project-focused work is not a new concept in private equity, doing so effectively and at speed across dozens of portfolio companies is a challenge. This playbook explores key strategic challenges private equity firms are facing today and how Operating Partners can use Consulting 2.0 to overcome those challenges to sustain a competitive edge.

The Role of Consulting 2.0

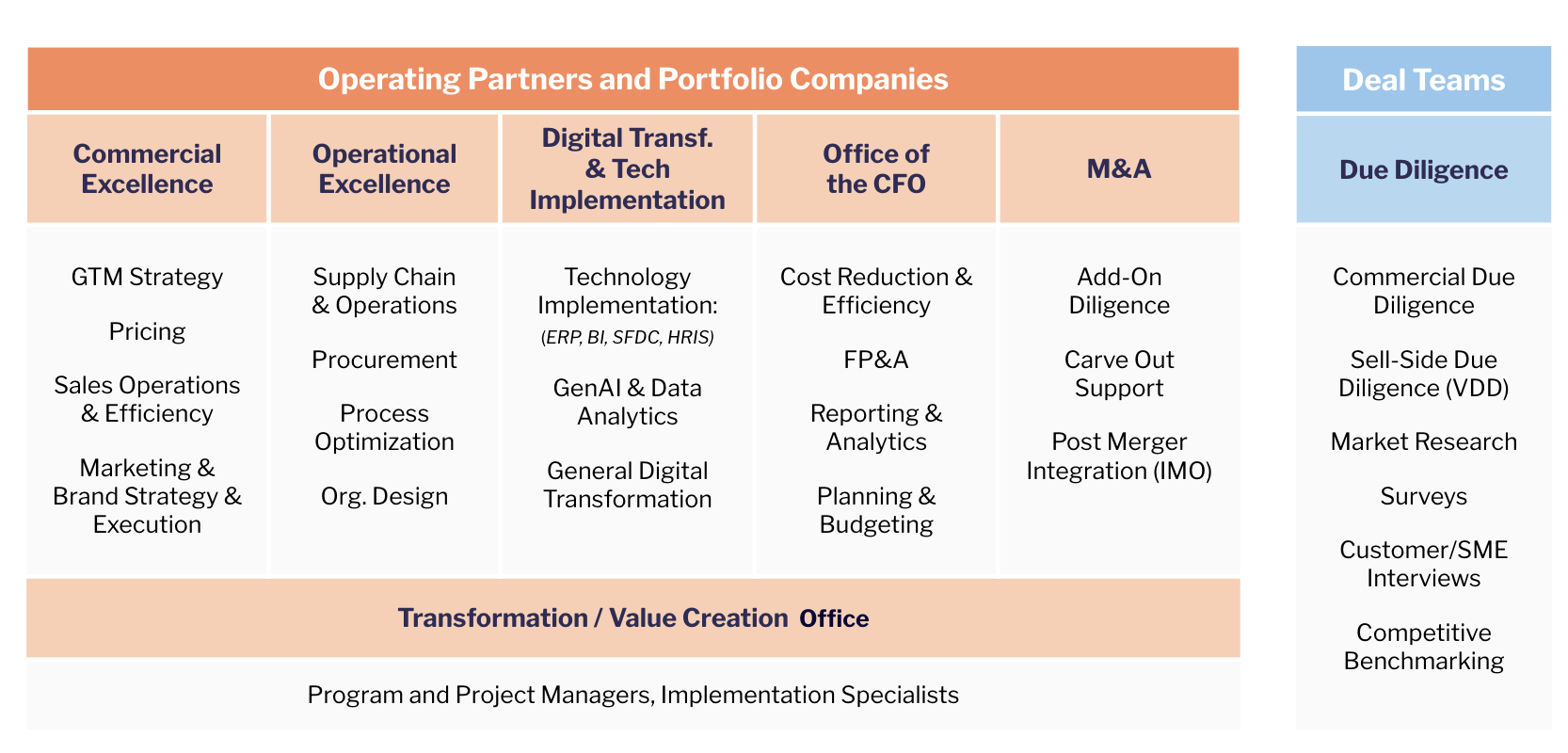

Consulting 2.0 for Private Equity Operating Partners

The pressure for accelerated deal cycles and successful value creation keeps increasing, and execution in these areas requires urgent access to the right expertise. Yet even the most well-resourced portfolio companies and operating teams often lack the specialized capabilities required to lead and deliver high-impact integrations and transformations on shrinking timelines. In the past, Operating Partners have leaned on hiring full-time leaders, which takes too long, or traditional consulting firms, which often miss the mark when layering in junior resources with limited operational depth and charge premium rates.

This is where Consulting 2.0 changes the game.

Catalant’s Consulting 2.0 model enables Operating Partners to tap into fit-for-purpose consulting — solutions tailored specifically to the workstream at hand — and benches of pre-vetted, on-call Experts who blend deep consulting acumen with hands-on operating experience. Operating Partners can move faster and accelerate value by leveraging proven operators with experience in PE-backed environments who have already solved the same challenges their portfolio companies face.

With Consulting 2.0, Operating Partners have the ability to:

- Accelerate execution by tapping into consultants and operators with targeted, firsthand experience

- Extend operating leverage without adding permanent headcount

- Access a bench of curated Experts who are ready to step in at a moment’s notice

- Drive more value with a flexible, right-sized model that ensures every dollar spent maps directly to outcomes

In an environment where speed, precision, and adaptability are the keys to value creation, Consulting 2.0 gives Operating Partners a competitive edge — one that scales with the demands of today’s deal dynamics and tomorrow’s portfolio opportunities.

Next in the playbook, we’ll explore why the following areas are getting attention from private equity partners and how firms are leveraging external Experts to successfully navigate strategic challenges in these areas:

M&A Integration Excellence

Value Creation

Finance Function Excellence

Performance Improvement

Exit Optimization

STRATEGIC CHALLENGE 1

M&A Integration Excellence

Mergers, acquisitions, and divestitures remain strong, but activity is increasingly focused and deliberate. Rather than pursuing volume, private equity firms are prioritizing high-conviction deals that align tightly with long-term strategic objectives. Carve-outs and add-ons continue to provide compelling value as companies streamline operations, divest non-core assets, and double down on growth areas. Integration capabilities directly impact value creation outcomes. Poor integration execution can destroy 30-50% of intended deal value, making integration important for portfolio success.

Critical integration workstreams that Catalant can help with:

- First 100 days planning and IMO standup: Preparing for success

- Day 1 readiness: Legal entity setup and operational continuity planning

- Systems integration: IT infrastructure consolidation and data migration

- Cultural alignment: Leadership assessment and organizational design

- Synergy capture: Revenue enhancement and cost optimization programs

Case Study

Post-Merger Integration and IMO Standup

The Challenge: A private equity firm specializing in scaling consumer companies made an add-on acquisition to an existing portfolio company and needed help integrating the two education-focused businesses.

The Expert: The Catalant Expert had led 7 post-merger integration processes before, in addition to previously serving as Chief of Staff at two PE-backed companies and had specific expertise in the education industry.

The Results: Applying his proven, in-depth PMI playbook, the Expert built out the 100 days plan (and beyond), integrating all business functions, including finance, HR, systems, marketing, and operations, and led all culture and communications initiatives. After the initial 6-month engagement, the Expert continued supporting the team through integration execution and IMO close, for another 6 months.

STRATEGIC CHALLENGE 2

Value Creation

With deal volume more measured and exit timelines extended, value creation has become the centerpiece of private equity strategy. Firms are increasingly focused on operational improvements, revenue growth initiatives, and margin expansion as core areas of value creation with opportunities for demonstrable results.

At the same time, executing on value creation plans is more complex than ever. Portfolio companies face macroeconomic uncertainty and resource constraints, and they often have limited in-house capacity to drive transformation at speed. Fit-for-purpose consultants who have solved similar challenges before can support value creation strategy and execution workstreams, filling gaps in talent and laying the foundation for measurable growth.

Case Study

Manufacturing Growth Transformation

The Challenge: A legacy B2B manufacturer and distributor of industrial parts, acquired by a private equity firm, faced increasing competition as buyers shifted to digital purchasing channels. Despite good products and longstanding customer relationships, outdated sales and marketing systems restricted growth potential.

The Expert: A Catalant Expert conducted a thorough assessment of existing sales motions and systems to identify improvement opportunities. They implemented new digital infrastructure, including Salesforce CRM and online customer portals, while realigning the sales force across legacy and digital channels. To measure performance, formal KPIs and reporting dashboards were established.

The Results: We successfully transformed the company’s go-to-market approach, resulting in 5% YoY revenue growth within six months post-implementation, 20% growth in new customer accounts alongside reduced churn, and 50% reduction in customer order processing time and support call volume.

STRATEGIC CHALLENGE 3

Finance Function Excellence

Capability gaps in finance can jeopardize value creation, especially when boards and lenders are demanding greater financial transparency and control. Operating Partners need scalable solutions that go beyond stepping in directly to manage these challenges.

Finance executives with PE-specific experience can immediately step into strategic financial leadership and analysis roles, providing continuity and developing a team’s capabilities. These Experts understand PE reporting requirements and value creation metrics.

Having access to a strong bench of flexible resources with hands-on experience as VPs and executives within the office of the CFO at private equity-backed companies can be a huge asset when a portfolio company is unexpectedly faced with a senior-level gap in the finance function.

Case Study

Financial Planning

The Challenge: Following two acquisitions, a private equity-backed retail company needed the support of a consultant to manage financial planning and analysis (FP&A).

The Expert: The firm hired a Catalant Expert with extensive FP&A experience. This person had experience working as an interim CFO, as well as in finance and M&A roles at PE firms.

The Result: Over two months, the Expert updated a leveraged buyout model and forecasted for the calendar year ahead of a board meeting. They also built an operating cash flow model.

STRATEGIC CHALLENGE 4

Performance Improvement

When a portfolio company misses growth targets or faces margin erosion, speed matters — and the margin for error is smaller than ever. In these moments, Operating Partners often turn to performance improvement: a specialized, high-impact approach to diagnosing inefficiencies, optimizing cash flow, and unlocking working capital.

It requires precision, speed, and the right expertise. That’s why Operating Partners rely on Catalant to quickly access proven specialists who can drive measurable improvements and help portfolio companies get back on track.

STRATEGIC CHALLENGE 5

Exit Optimization

Today’s exit environment is highly selective and value-conscious, which requires earlier planning, sharper positioning, and tighter execution for firms preparing a portfolio company for sale. Exit preparation cannot be treated as a last-mile exercise — it must begin well in advance and strategically align financial performance, growth narrative, and operational readiness.

As management teams are already stretched thin, the demands of exit prep can easily overwhelm internal capacity. Independent consultants with deep exit experience can step in to lead or support critical workstreams, ensure that key metrics are investor-ready, and help shape a compelling equity story. This type of flexible support can not only increase exit speed but also allows Operating Partners to manage multiple exits across the portfolio without sacrificing quality or focus.

Case Study

Acquisition Planning

The Challenge: A talent search firm needed to optimize its operations, financial reporting, and overall valuation to appeal to potential buyers.

The Expert: The firm hired an experienced former CFO to transform its strategic positioning and create a comprehensive roadmap for acquisition. Key efforts included developing a scalable growth strategy and preparing a robust due diligence package.

The Result: The company successfully attracted a global workforce solutions buyer. The strategic preparation ensured a seamless transition, maintained client relationships, and positioned the firm as a valuable market asset.

conclusion

Setting Up for Strategic Success as an Operating Partner

Operating Partners today are being asked to do more with leaner internal teams, tighter timelines, and greater scrutiny from LPs and boards alike. In this environment, execution requires speed, precision, and access to the right expertise at the right moment.

Relying solely on in-house capacity or traditional consulting models in this environment limits your ability to move quickly and execute effectively. By embracing a fit-for-purpose approach and tapping into a curated bench of independent consultants, firms can unlock real flexibility — bringing in seasoned operators with targeted expertise to drive execution where it matters most.

Does your team have the right support to navigate these strategic challenges?

Whether you need to fill talent gaps, tap into expert support in the deal process, or focus on value creation, we’ll connect you with Catalant Experts who have hands-on experience.