The Ultimate Guide to Private Equity and Private Equity Consulting

To raise capital, companies can turn to conventional methods like taking out loans, issuing stock, and selling bonds. Or they can use private equity, an unconventional alternative that continues to rise in popularity.

In 2021, private equity fundraising increased nearly 20 percent year over year, reaching a record-breaking $1.18 trillion, according to data from McKinsey’s Private Markets Annual Review. Private equity assets under management also broke a record, reaching $9.8 trillion as of July.

As more investors turn to private markets and these markets continue to add trillions of dollars in assets, it’s important that you understand what private equity is, how it works, what strategies PE investors and firms use, and how PE consultants can help them be successful.

Private Equity

Private equity refers to capital investments made into private companies, or public companies that are taken private, in exchange for company equity. The goal of these investments is to purchase shares to fund the company’s growth and then sell at a higher value in order to make a profit.

These investments are controlled and managed by private equity firms. In addition to funding, PE firms often provide mentorship, industry expertise, best practices in strategic planning, and assistance with talent sourcing, among other services.

Now that we have a better understanding of what private equity is, let’s look at how it works exactly.

How does private equity work?

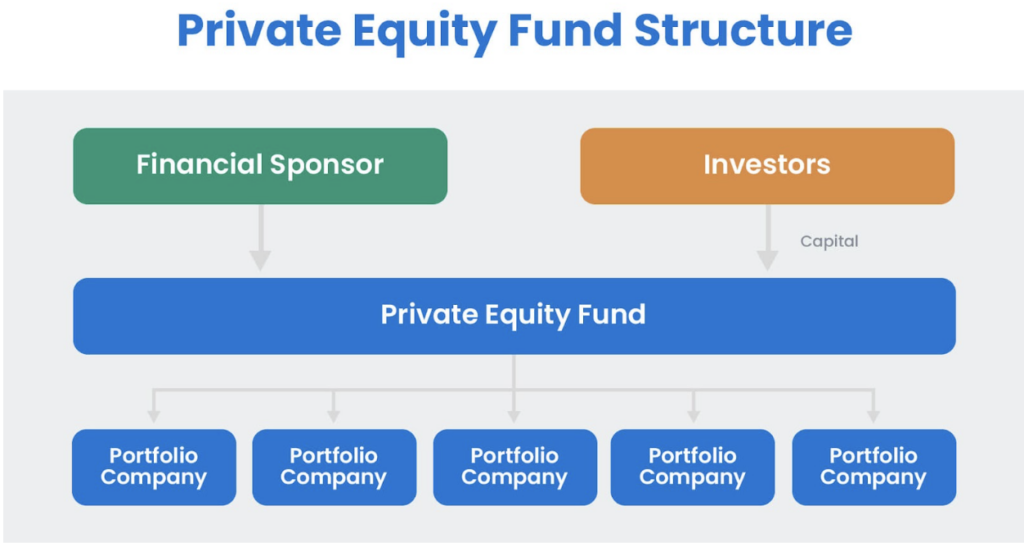

A private equity firm raises funds from institutional investors, like pension funds and university endowments, and high-net-worth individuals. Acting as the financial sponsor, the firm invests that money in purchasing and selling businesses. These businesses are referred to as portfolio companies.

Take a look at this image to better understand what a PE organization structure looks like.

In order to make direct investments in portfolio companies, a private equity fund must contain a significant amount of capital. That’s why most funds have a minimum entry requirement ranging from $250,000 to millions. This enables the PE firm to invest in several portfolio companies at once. According to data from Private Equity info, private equity firms hold a median of 7 portfolio companies at a time.

PE firms typically target companies at a certain point in their lifecycle. For example, different PE firms may target start-ups, established companies, or failing companies, depending on their strategy. The goal of each is to buy the portfolio company at a lower sum, provide financial and intellectual capital in order to guide it through a period of rapid improvement, and then sell it for a much higher return.

Let’s say a public company is underperforming. A PE firm may buy it, delist the company, bring in new management, and execute several initiatives to improve its financial performance. The goal of this hands-on approach in managing and shaping the direction of the portfolio company is to increase its value in order to sell it to another PE firm or company, or take it public again in an initial public offering (IPO), for more than its original investment. When the company sells, the PE firm may take a percentage of gross profits.

The PE firm aims to yield favorable returns for investors within a specific time frame (usually four to seven years). If it is successful with a fund, then it will more likely be able to raise money for future ones.

What is a private equity firm?

A private equity firm is an investment management company that uses capital from investors (and sometimes its own funds) to invest in businesses with the goal of increasing their value in order to sell them at a profit.

PE firms tend to be smaller than investment banks — maybe as small as 5–10 employees — according to the CFA Institute. These employees are known as fund managers or general partners. They raise capital from investors, who are known as limited partners.

In addition to raising capital, general partners are responsible for investing that capital, managing the portfolio of companies they’ve invested in, and exiting these companies at a profit (likely through an acquisition or IPO). As a result, they are typically compensated in two forms.

The first form is management and performance fees, which are charged as a small percentage (around 1-2%) of the committed capital of the fund. This does vary by firm, though. Some firms may charge management fees as a percentage of the total amount of capital controlled by the general partner, which may include leverage or borrowed money. The second form is a percentage (typically 20%) of gross profits from investments.

To understand what this percentage might mean in terms of dollar amount, consider that buyout funds unloaded $957 billion in assets globally in 2021, according to Bain & Company’s Global Private Equity Report. This is more than double the total in 2020 and 131% more than the five-year average, so it’s no wonder that private equity continues to attract some of the best talent as well as investors.

Why do the private equity markets continue to smash records in terms of buyouts, dealmaking, and exits? Most private equity firms are not listed publicly, which means their shares are not traded in the stock market. It also means that these firms do not need to comply with many of the regulations that public companies do. This is one reason that private equity markets can offer greater returns than public equity markets.

The other (and more prevalent) reason is its strategies, which combine business and investment portfolio management. Let’s take a closer look at them below.

Private Equity Strategies

There are many types of private equity strategies that vary based on the portfolio company’s lifecycle. Let’s take a closer look at the four most common below.

1. Leveraged Buyouts

Leveraged buyouts are a common PE strategy that takes place late in a company’s lifecycle. With this strategy, a PE firm takes a controlling share of a company (typically one that’s underperforming or undervalued) in a mature industry. This buyout is unique because it’s financed through loans, which are granted using the assets of the acquired company as collateral. This enables the PE firm to put up a fraction of the purchase price.

Then, if the PE firm is able to guide the portfolio company through a period of rapid improvement, it can sell it or make it public again for a massive return on investment.

2. Managed Buyouts

Managed buyouts are similar to leveraged buyouts. They also take place late in a company’s lifecycle and with the goal of placing the company under new control to improve its performance and ultimately provide the greatest return for investors.

What’s different with managed buyouts is that the existing management team takes the controlling share of the company. In order to do so, they may need to raise funds through a PE firm, which would ask for a minority share in the company in exchange. Before the existing management team takes over, all investors and stakeholders can cash in on their shares.

3. Growth Capital

Growth capital is a PE strategy that takes place earlier in a company’s lifecycle. With this strategy, a PE firm invests in an established company that’s trying to scale. The company may need funding to hire employees, rent office space, or purchase equipment to meet rising demand. In exchange for this funding, the PE firm will ask for company equity.

The advantage of this type of investment is that the PE firm can gather a lot of data about the target company through client interviews, product demos, its financial track records, and more to estimate what type of return it can provide.

4. Venture Capital

Venture capital is another form of private equity. Venture capital investors make smaller investments in fast-growing companies or startups typically in less mature industries. Since this strategy takes place earliest in a company’s lifecycle, these companies are likely limited by a lack of revenues, cash flow, or debt financing — all of which can be solved by venture capital funding.

In exchange for funding, investors will ask for company equity at a minority stake (50% or less). Then, if the company is acquired or goes public, the investors will see returns.

Private Equity Exit Strategies

To maximize their returns, private equity firms must devote as much time and careful planning to exiting their portfolio companies as they do to purchasing and transforming them. Below are the most common exit strategies.

Initial Public Offer (IPO)

An initial public offer is one of the most common exit strategies for PE firms. With this strategy, the firm offers its shares of the private company to the public. At this point, their shares become worth the public trading price so they can choose to sell a portion or all of them. This exit strategy can help a PE firm realize the full profit from their private investment, but it does require them to meet strict requirements by exchanges and the Securities and Exchange Commission (SEC).

According to data from Bain & Company’s Global Private Equity Report, IPOs increased in global buyout-backed exit value from $67 billion in 2020 to $112 billion in 2021.

Merger & Acquisition (M&A)

Another common exit strategy is a merger and acquisition (also known as a trade sale). With this exit strategy, the PE firm sells the portfolio company to another company for a profit. Usually, the portfolio company is complementary to the buyer’s so acquiring it is faster and cheaper than building another company from scratch. As a result, the buyer is often willing to pay a premium price.

It’s common for a private equity firm to invest in a middle-market company in the hopes of selling it to a large corporation for impressive returns. This was a particularly effective strategy in 2021. Corporations spent $458 billion buying former portfolio companies, which was double what they spent in 2020, according to Bain & Company’s Global Private Equity Report.

Secondary Buyout

A secondary buyout is an increasingly common exit strategy in which one private equity firm sells its portfolio company to another firm or financial sponsor. The reason may be that the selling firm has already realized significant gains from its investment. Or it may be that the selling firm has reached its limit (financial or otherwise) of being able to improve the portfolio company.

This exit strategy is appealing because it offers the selling firm the instant liquidity of an IPO without all the regulatory requirements.

Buyback

Another option is for management to buy back the company equity from the PE firm once they’ve ushered it through a period of improvement. This is a great option for both the PE firm and its investors and the portfolio company’s management.

Liquidation

Liquidation is the least desirable exit strategy. It is often a last resort if the private equity firm has not been able to improve the financial performance of the portfolio company, or make other necessary changes.

Private Equity Consulting

Private equity consulting refers to a broad range of services that are designed to help private equity firms make better investment decisions and earn greater returns.

This type of aid is critical as investors increasingly turn to private markets and PE firms raise more funds. According to S&P Global Market Intelligence, the global private equity industry recorded dry powder of $1.78 trillion in February 2021, which fell just short of the all-time high of $1.81 trillion set in January. Dry powder is capital that’s been committed by investors but has not been allocated to a specific investment. One quarter of this total — or $460.12 billion — is held by the top 25 firms.

Since these firms are raising more and more money, they are doing bigger and bigger deals. According to Bain & Company’s Global Private Equity Report, average deal size rose over the $1 billion mark in 2021 for the first time ever.

To best allocate this capital, these top firms and others can benefit from private equity consulting to best allocate this capital.

While the exact services will vary by consulting firm, they will typically help general partners at PE firms throughout the deal lifecycle by:

- Evaluating portfolio companies to invest in: Evaluating which investment options are viable and which aren’t is one of the most time-consuming activities of a general partner. A consulting firm can help with the evaluation process by analyzing current market trends, potential risks, and the financial situation of portfolio companies.

- Choosing which portfolio companies to invest in: After evaluating hundreds of investment options, general partners at a private equity firm must narrow down the viable options to the best few. What “the best” means depends on factors like industry trends and a portfolio company’s market position, stability of revenue, and potential for growth. A consulting firm can help with the research, data collection, and analysis required to make an informed decision.

- Increasing the value of portfolio companies: Many consulting firms continue to partner with general partners after acquisitions to help increase the value of portfolio companies. They may help create and execute strategies for growth, pricing, and operational efficiency, align management with strategic priorities, and more.

- Exiting portfolio companies: Consulting firms may also help general partners to plan, prepare, and execute exit events, including acquisitions by a company or initial public offerings. They often help by providing a deep understanding of industry trends, the buyer landscape, and key risks that may affect the business or exit route.

The individuals who help with this strategic planning, cross-functional work, and value creation execution are private equity consultants. Let’s learn more about them below.

Private Equity Consultant

A private equity consultant is an expert who provides opinions, analysis, and recommendations to PE firms. They can work for a firm or independently.

Independent private equity consultants offer benefits over hiring a full-time employee or a full team from a consulting firm — namely, they can make a more immediate impact in areas like post-merger integration, lead generation, and financial planning and analysis.

For example, a private equity consultant may be hired by a PE firm to help them create value for their portfolio companies. One way they might do that is by reviewing and recommending changes to the portfolio companies’ pricing strategy based on market research, the companies’ positioning, and growth trends.

Private Equity Consultant Salary

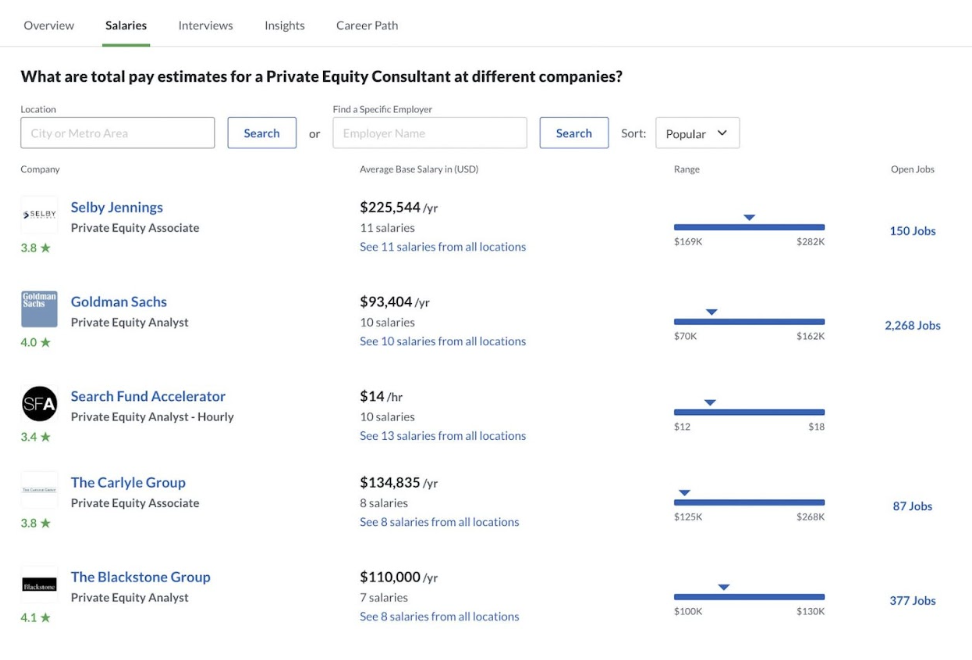

Glassdoor estimates that the median salary of a private equity consultant is $98,458 per year based on salaries collected from its users, with the most likely range from $67,000 to $155,000.

Where a PE consultant falls in the estimated pay range will depend on their firm, job title, years of experience, and other factors. Take a look at the range of salaries by company below.

What are the advantages of private equity?

Private equity can offer a wide range of benefits to businesses and investors, many of which we’ve discussed above. Here are three of the biggest advantages:

- Less volatile markets

- Returns that are better over time

- Freedom from some public regulations and restrictions

- Access to alternative capital for underperforming or undervalued companies

- Focus on overall growth instead of quarterly performance

What are the disadvantages of private equity?

Private equity does pose risks as well, which we’ve discussed above. Here are three of the biggest disadvantages:

- Lack of liquidation

- Some sectors perform better than others

- Often requires changes in management and company structure

- Can be a long process

- Limited control for investors

Understanding Private Equity

Private equity — and the firms that manage it — can help companies raise capital, improve their performance, and ultimately increase shareholder value. As PE firms go after bigger and bigger deals private equity consulting can help those firms make the smartest investment decisions and yield the highest returns.

Learn how Catalant supports PE firms across the entire deal cycle.

Read MoreRelated Articles

Share Article