Service Offering

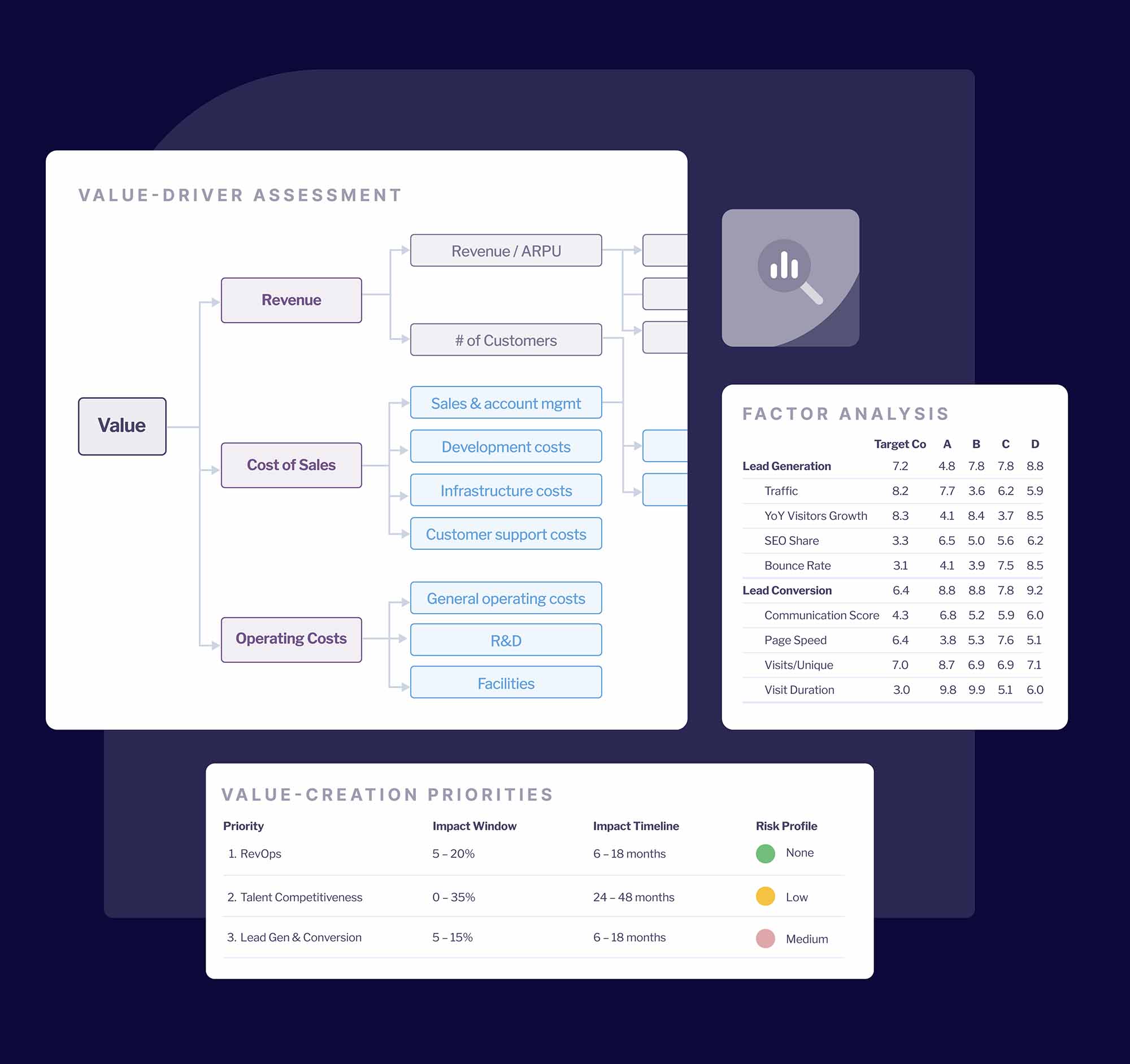

Opportunity Assessment & Value Creation

In today's high-multiple investment environment, private equity firms face mounting pressure to deliver superior returns from portfolio companies. Catalant Experts blend operational rigor gained from Fortune 500 leadership roles with analytical frameworks honed at top-tier consulting firms to:

APPROACH

Transform Strategic Vision Into Measurable Results

01

Diagnose opportunities

Perform operational assessments across people, process, and technology to identify high-impact improvement areas. Deploy analytical tools to surface hidden inefficiencies and profit leaks within portfolio companies.

02

Create value roadmaps

Create actionable strategic plans aligned with investment theses, focusing on specific growth and optimization levers. Prioritize initiatives based on potential impact, resource requirements, and implementation complexity.

03

Drive execution excellence

Translate strategy into execution through proven methodologies that bring value creation plans to life. Establish cross-functional accountability with clear ownership and aligned incentives.

04

Build tracking systems

Define KPIs and build tracking mechanisms to actively manage strategic initiatives. Create dashboards providing real-time visibility into progress against value creation targets.

05

Deliver sustainable change

Embed value creation in organizational DNA through structured change management. Address implementation barriers proactively to maintain momentum throughout transformations.

WINNING TOGETHER

Opportunity Assessment & Value Creation Use Cases

Problem

A legacy B2B manufacturer and distributor of industrial parts, acquired by a private equity firm, faced increasing competition as buyers shifted to digital purchasing channels. Despite good products and longstanding customer relationships, outdated sales and marketing systems restricted growth potential.

Action

Experts conducted a comprehensive assessment of existing sales motions and systems to identify improvement opportunities. They implemented new digital infrastructure, including Salesforce CRM and online customer portals while realigning the sales force across legacy and digital channels. To measure performance, formal KPIs and reporting dashboards were established.

Results

Successfully transformed the company’s go-to-market approach, resulting in:

- 5% YoY revenue growth within six months post-implementation

- 20% growth in new customer accounts alongside reduced churn

- 50% reduction in customer order processing time and support call volume

Financial Process Optimization

A rapidly growing hospitality company struggled with cumbersome manual processes in legal and financial functions. Cross-functional inefficiencies resulted in month-long reporting delays, contract bottlenecks exceeding 60 days, and significant employee burnout. Through targeted process assessment and system implementation, Experts reduced contract turnaround time from 15 to 3 days, eliminated $3 million in external legal expenses, and streamlined expense reporting through improved data integration.

Commercial Operations Transformation

A PE-backed cybersecurity company struggled with siloed Sales and Customer Success teams, fragmented data, and unclear account ownership limiting lifecycle visibility. Catalant mapped the end-to-end sales process and customer journey to identify structural gaps, then implemented a unified KPI framework linking leading and lagging indicators. This identified approximately $6M in value from optimized segmentation, unified reporting for data-driven revenue management, and improved forecast accuracy with clear accountability.

featured experts

Opportunity Assessment & Value Creation Consultants

Christopher B.

Ex-Deloitte, PwC, Motorola strategist specializing in value creation and M&A

Identifies opportunities across operational efficiency, commercial and RevOps excellence, digital transformation, and M&A. Executed over $50B in transactions with proven methodology for EBITDA growth in PE-backed firms and corporations.

Oyinda A.

Ex-PE operations and strategy consultant with executive leadership experience

Leads post-merger integrations, value-creation playbooks, and GTM strategies for PE-backed companies with 10+ years of experience. Drives operational improvements across middle-market and Fortune 500 organizations that deliver measurable value creation.

Lynn S.

Ex-McKinsey consultant and Kaplan GM delivering $500M+ transformation results

Delivered $500M+ in value creation for private equity portfolio companies and middle market firms. Provides full-stack transformation services from opportunity identification through bankable plan development and interim leadership execution

Is your portfolio realizing its full value potential?

Connect with dozens of consultants qualified and ready to do this work.