Market Research Takes the Lead

At our Executive Strategy Session last month one of the speakers asked the room of Fortune 1000 executives whether they believe we’re headed toward a recession. Among the nearly 100 leaders in the room, the opinion was split down the middle. There’s no crystal ball, and the reality is every leader needs to remain flexible as we weather whatever storms are ahead.

We looked to our customer data to help us understand how companies are spending time during this period of uncertainty. The data from our platform, based on projects from private equity firms and the Fortune 1000, reveals that companies are spending more time working to understand their customer needs, competitive landscape, and market dynamics.

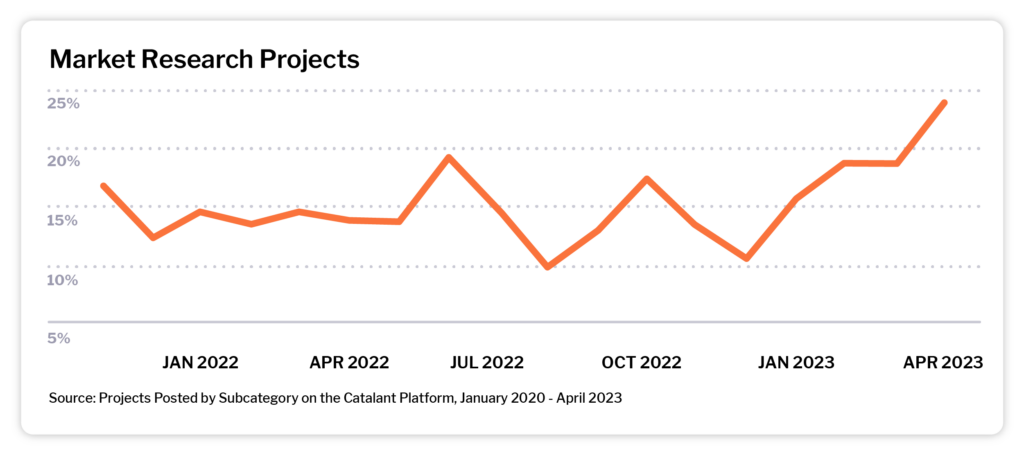

Market research projects rise as companies look to find growth opportunities.

Over the last year and a half market research has averaged about 15% of project volume on the Catalant platform. Last month, however, activity spiked to nearly 25% of all projects, an annual high and approaching an all-time record over the past 10 years.

What’s interesting about this particular trend is that the work is spread across many types of research. Typically this isn’t the case. In 2022 voice of the customer projects were nearly twice the volume as market mapping projects, for example. But today we’re seeing a more distributed spread.

We believe this is a signal of companies redirecting their attention from the bottom line (a primary focus at the start of 2023) to prioritize the pursuit of top-line opportunities. Whether it’s market mapping, TAM analysis, or market landscape projects, companies are considering both inorganic and organic growth opportunities, while at the same time PE firms are anticipating a potential return to deal activity in the second half of the year.

Qualitatively, we see this within projects posted on Catalant throughout the month of April. While some firms are focused on assessing M&A opportunities, others are leaning into maximizing the growth potential of 2022 acquisitions and researching potential organic growth levers.

- A manufacturing company wanted to accelerate through inorganic growth. It specifically was interested in software-based solutions to enhance its existing product offering, which in turn would allow it to sell into new segments of the market. To find the right targets, the company hired an independent consultant with industry expertise to evaluate target companies, qualify them, and provide value-creation hypotheses about each.

- A leader in building materials acquired a company to expand the offering of one of its core business units. After fully integrating the company it needed a consultant to accelerate its value creation plans by assessing white space relative to vertically integrated players in the category and proposing markets to prioritize.

- A CPG company’s investment arm is considering how Fintech impacts its broader direct-to-consumer strategy. To better inform their approach, they hired a consultant to assess why certain companies are investing in advanced digital payments and how that could fit into this particular company’s strategy.

This trend is visible beyond our data as well. Recent stories of large enterprises exploring growth through acquisition and industry expansion include Apple and L’Oreal:

- Apple announced an expansion of its financial services business with a high-yield savings product, delivered through a partnership with Goldman Sachs. This advances Apple’s strategy of expanding Apple’s financial service offerings.

- On the consumer goods side, L’Oreal announced its largest ever acquisition — a $2.5B deal to acquire Australian beauty brand Aesop. The move positions the French company for growth in the Chinese market, building upon Aesop’s recent growth in the country.

What it means for your organization:

Business leaders are turning to Catalant Experts to conduct research on how market dynamics are impacting the sectors they play in. As organizations emphasize a short-term focus on the bottom line, they are also seeking new paths to grow topline opportunistically. One clever way to think about this was presented by a speaker at our Executive Strategy Session:

Topline, no bottom line: Waste of time

Bottom line, no topline: Matter of time

Over the past few months, companies reacted to the former. Now, they’re realizing the implications of the latter.

*Data is based upon projects posted on the Catalant platform, and shows posting volume by project category or subcategory as a percentage of total project volume. While we have used reasonable efforts to ensure the accuracy of the data used in this newsletter, data should be read as indicative of magnitude rather than exact figures.