Is M&A coming back?

We’re excited to bring you the inaugural edition of Catalant Insights.

As our client base scaled over the past several years, we noticed time and again that the thousands of data points in our platform were telling a story about real-time market changes. We’ve seen supply chain challenges before they were on the front page of the New York Times, the pressure for digital transformation reach an all-time high, and a major spike in organizational design work with an eye toward positioning the company for the future.

As we’ve shared this data with more and more clients, we’ve realized the insights we have can be useful to all of the companies we partner with. That’s the goal of Catalant Insights — to provide a view into what your peers are focused on, give access to real-time market data, and help you prepare for the challenges ahead.

1. Strategic resource allocation stays top of mind.

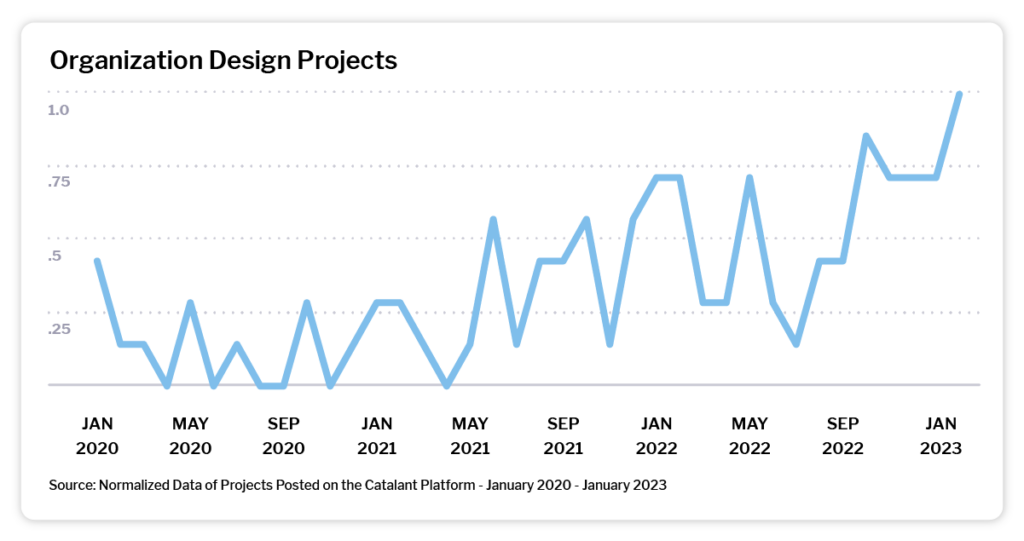

In our year-end 2023 Agile Consulting Trends Report, we highlighted an uptick in organizational design projects. This trend continued into 2023 with organizational design projects posted to Catalant reaching their highest volume ever in January.

We’ve heard from companies that these adjustments are not just cost-focused; they’re driven by the realization that there is a lack of alignment between organization design and overall corporate strategy at many companies today. Some organizations are even creating roles focused on effective resource allocation to assess and realign the organization’s structure to support the overall strategic objectives of the business.

One of the largest examples of this is The Walt Disney Company’s restructuring announcement that was made in February. While the company is reducing headcount, it is also realigning into three divisions to bring more focus to the company’s strategy.

Here are some specific examples we saw in our platform:

- A F500 retailer is creating a new workforce model for one of its major divisions, with the potential for this model to be adapted across the business if and when it shows promise.

- A global CPG company with a ‘house of brands’ strategy is redesigning how it interfaces with each of its individual brands, leveraging shared services for some functions and allowing operational autonomy in others, depending on where each fits within the market and the broader opportunity.

2. Is M&A bouncing back?

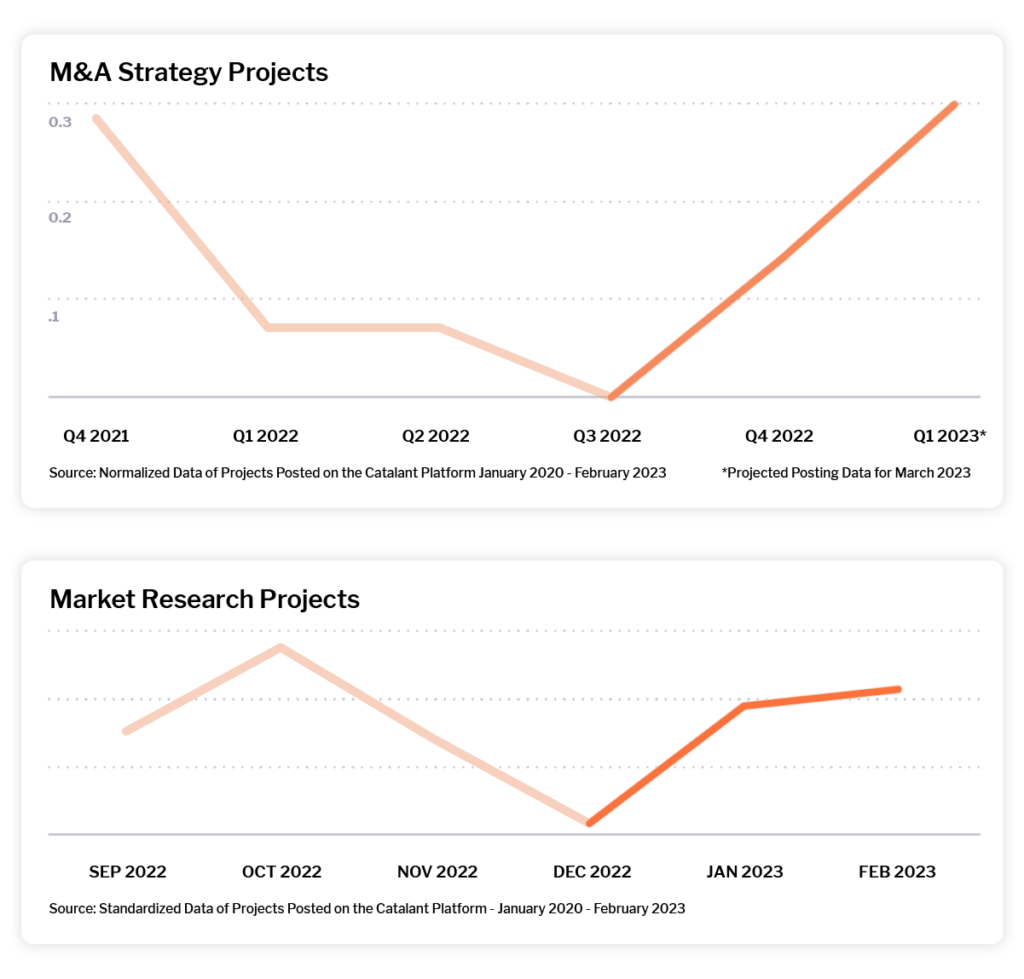

After a 38% drop in volume from 2021 to 2022, we’re beginning to see signs that the M&A market may be ramping up again, both in our data and in the conversations we’re having with Managing Directors. After a drop in volume in the first half of 2022, M&A strategy project volume has swiftly rebounded over the past two quarters. And market research projects supporting thematic diligence have seen a dramatic increase starting in December, coming back to a volume we haven’t seen since early last fall. Qualitatively, there are early signs of debt package costs coming down and a consistent belief in the market that we are three to six months from a real turning point. Many firms starting to form opinions on the markets they want to play in and the companies they want to target.

What’s particularly interesting about this uptick in volume is the type of projects vary based on industry and risk tolerance. On one side, there is preparation for a flurry of activity in the near future:

- Private equity firms are hiring independent consultants to build target lists and conduct thematic research to prepare for activity and move quickly when debt package costs decrease.

- Subway announced in mid-February that it was exploring a sale, one of the first moves into what’s expected to be a busy M&A market later this year in 2H.

On the other end of the spectrum, both private equity and corporate development teams are divesting and carving out brands to optimize balance sheets:

- In February, J. M. Smucker sold its pet food brands, including Milkbone and 9 Lives, to Post Holdings.

- Also in February, Unilever sold its Suave brand in North America to Yellow Wood Partners.

3. Dynamic talent sourcing continues to grow.

As the employee-employer balance of power continues to shift, employers and employees alike are opting for dynamic talent models to protect against the impact of rapid shifts.

As noted in CIO, temporary talent sourcing, when done right, brings huge benefits.Research from Legal & General shows the lasting nature for independent work as a means of making a living is largely an option made by choice and not necessity.We see the same trend in our expert community — the type of talent who opts to build a 40-hour work week through project-based work is seasoned, smart, and very likely to be among the best at what he or she does.Find more examples of the types of people who are choosing to work independently here.