Quick Win Pricing Strategies that Generate Results

Boost the top line with pricing quick wins in manufacturing

Manufacturing businesses can measurably improve revenue and margin through pricing quick wins, i.e., pricing actions that deliver measurable ROI within 3 to 6 months. Savvy leaders often use quick wins to build consensus and excitement to drive longer-term pricing excellence, which can include strategic pricing, pricing governance, and pricing performance monitoring.

Keep in mind that many manufacturing businesses face pricing challenges due to large product portfolios, multiple production sites and sales regions, various stakeholders, and limited insight into customer behavior. These challenges will require deeper investigation than a quick win approach can offer.

Let’s dive into five pricing quick wins that I use with manufacturing clients to successfully improve top line performance and lay a foundation for longer-term pricing excellence:

- Set prices logically

- Enforce price floors

- Reduce price variation

- Be strategic when increasing prices

- Monetize customer conveniences

1. Set prices logically

Establish pricing clarity and apply across contexts to maintain consistent business performance.

To maintain consistent business performance, it’s crucial to establish pricing clarity. Make sure your product price formula considers cost and value-added product features, and be sure that the formula is applied across all products and facilities.

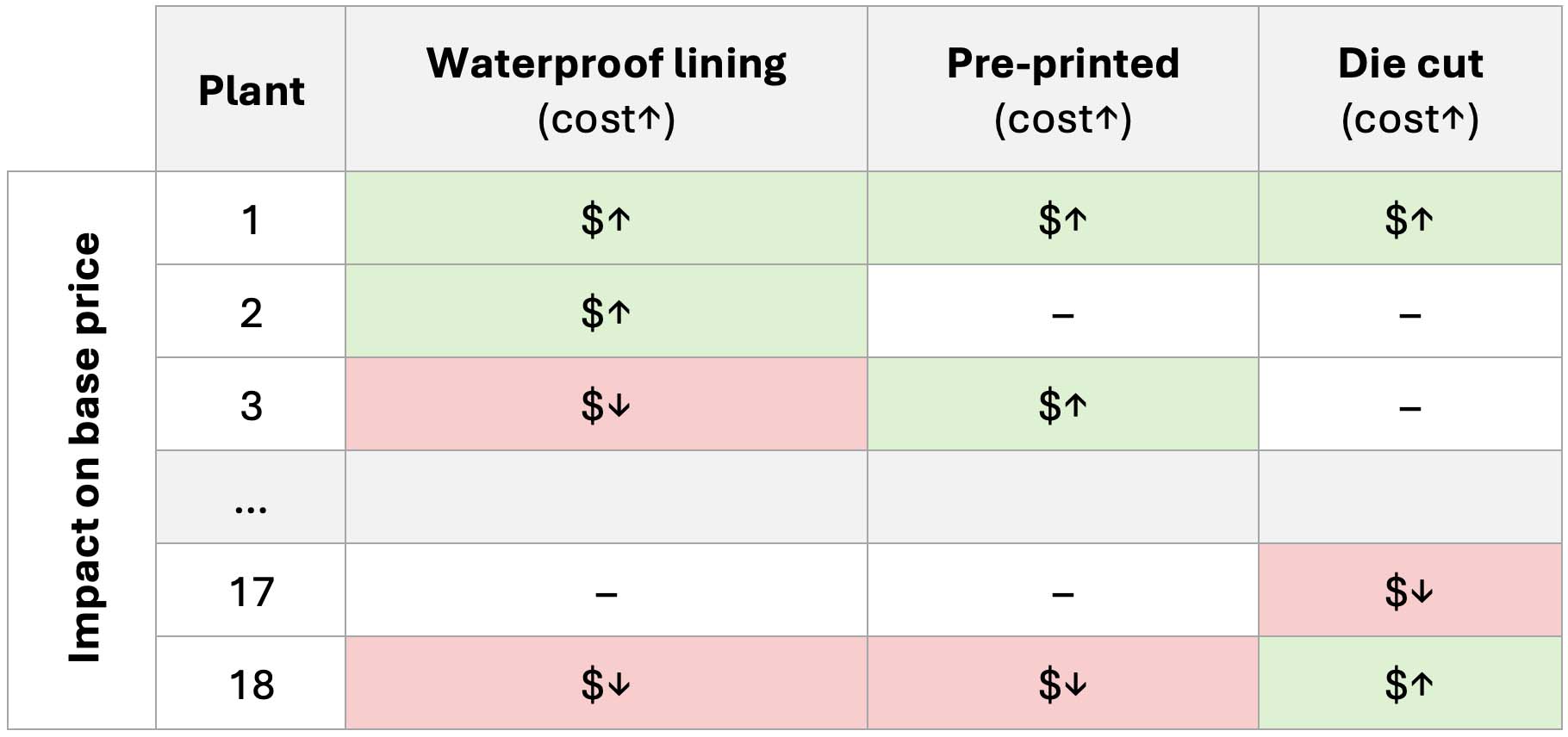

Consider a recent client that produces cardboard boxes. The cost increases if the box has waterproof lining, if it is pre-printed with the buyer’s logo, and if it is die cut. When we analyzed the base price for a basic box across their 18 plants, we discovered that pricing didn’t always follow cost, and at times was even counterintuitive, as shown in the table below. The takeaway? The client knew they had to align their base price formula to follow costs and to follow it consistently to protect (and in this case, increase) their margins.

2. Enforce price floors

Establish and enforce a price that cannot be further discounted.

Unless you revel in the world of rock-bottom margins, it is important you draw a line in the sand when it comes to price points.

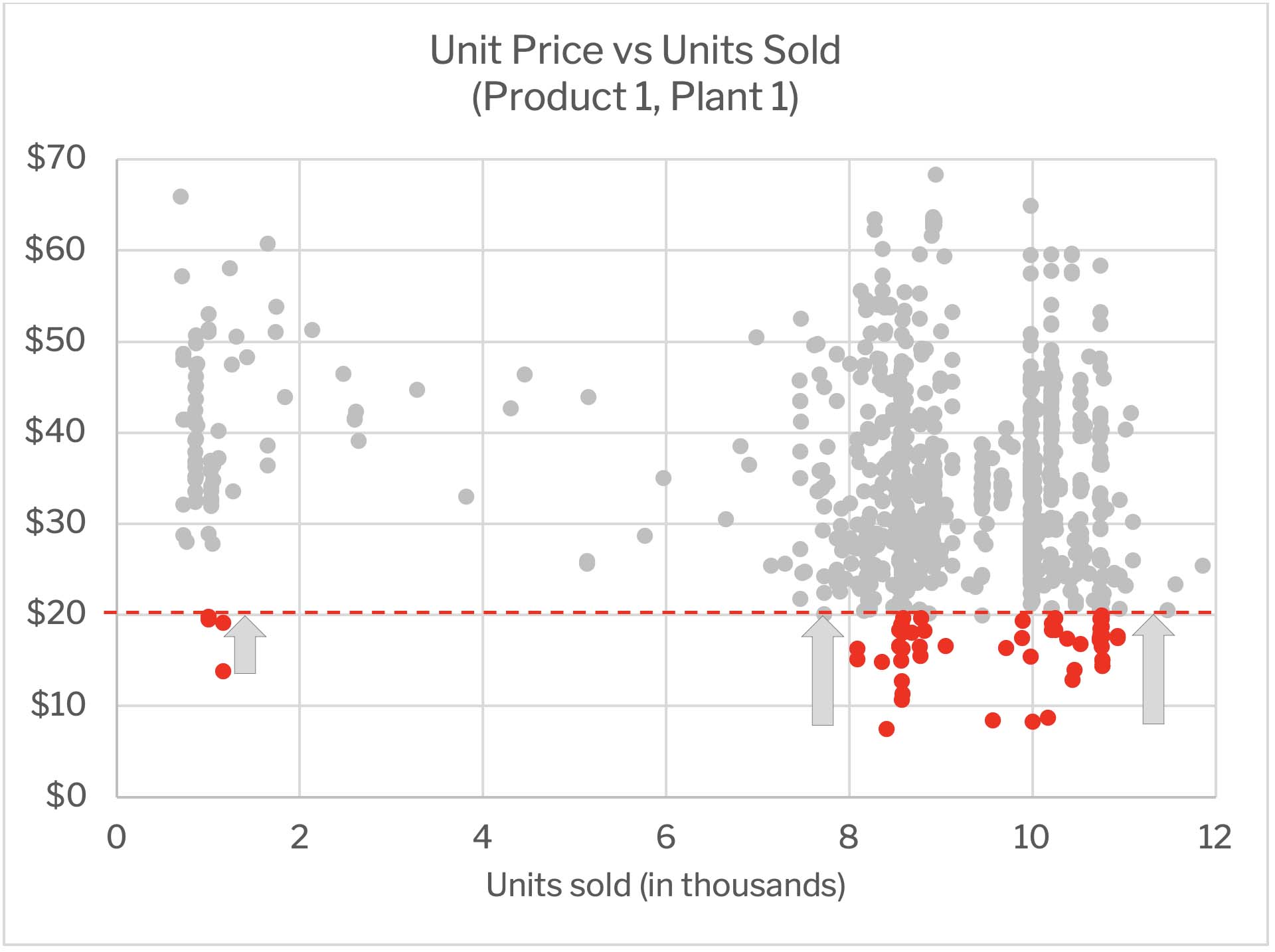

A client with $700 million in annual revenues and nine facilities faced margin erosion due to unbridled discounting that resulted in some eye-wateringly low selling prices, captured below in a scatter plot of unit price vs. units sold. This problem is not unique to this single client – this pattern is common across manufacturing businesses of all kinds and sizes.

The quick-win solution was to eliminate the most extreme outliers, which in the above case was done by introducing a relatively modest price floor of $20 per unit. By introducing similar price floors across the leading SKUs (while excluding some strategic accounts and contractual obligations), the company saw its revenues increase by 2.3% in the very first quarter without loss of unit volume.

3. Reduce price variation

Comparable customers should pay the same price per unit.

Say you have two customers, Customer A and Customer B, who both purchase 100 units of the same product. Customer A pays $10 per unit and Customer B pays $15 per unit. If both customers are comparable (e.g., similar contract size, location, product mix, etc.), both should be paying the same price per unit. The low price given to Customer A creates revenue leakage that should be plugged and prevented without delay.

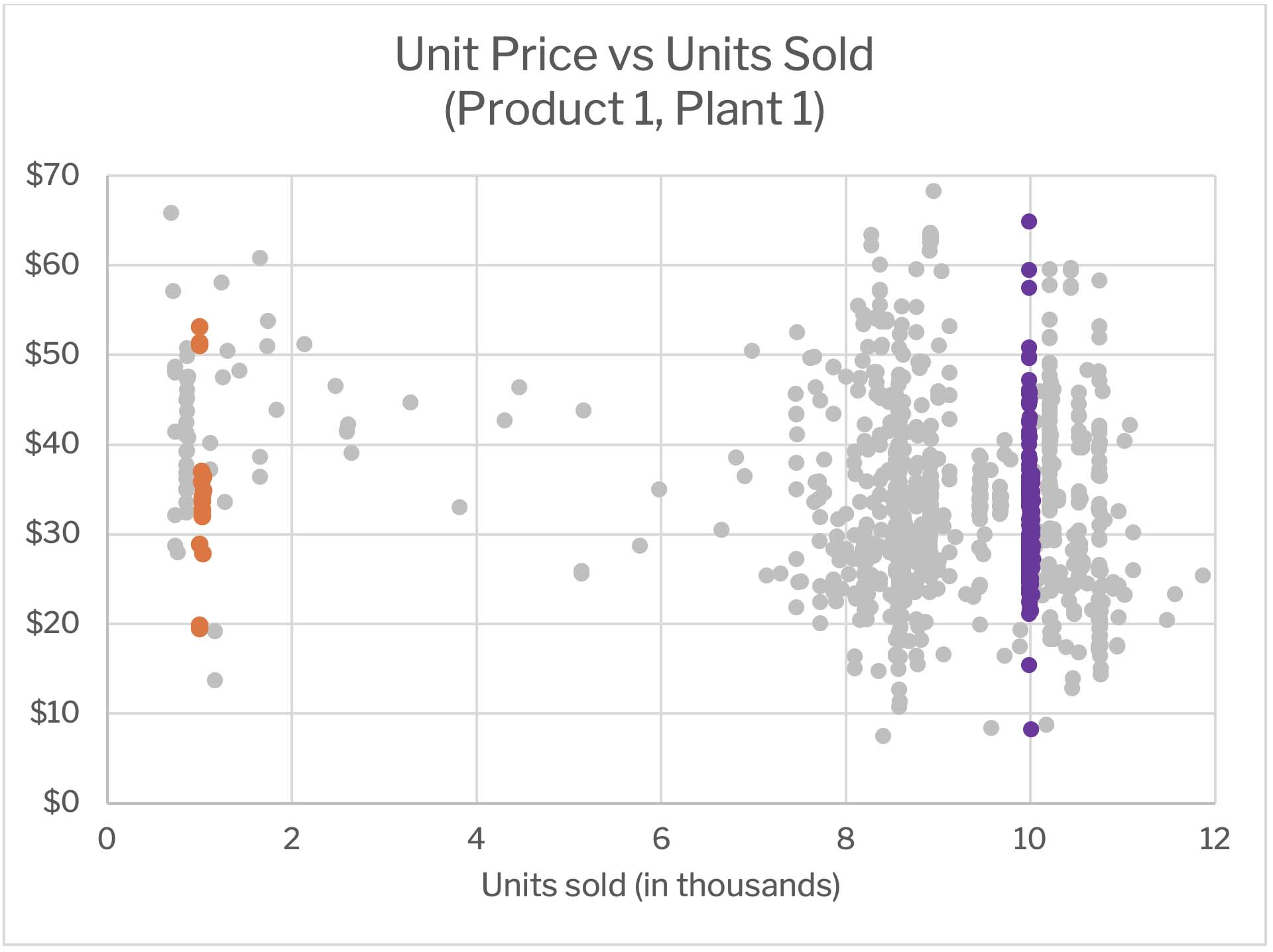

To illustrate this point, let’s revisit our earlier example.

While we observe significant price variation across the entire spectrum of transactions, there are two clusters that are useful to study. The first cluster, shown in orange, is for orders in which about 1,000 units were sold. At this unit volume, we see prices vary from $20 to $53 per unit.

The second cluster, in purple, is for orders that were 10 times the size with about 10,000 units. Here the price swings from $8 to $65 per unit.

Some price variation is normal, allowable, and to be expected. For example, low unit prices are sometimes offered to acquire a strategic customer or when rewarding loyal customers. However, large variations in unit prices, as in the example above, are symptoms of ad hoc pricing practices across product lines, sales teams, and even sales reps.

In addition to price floors, you must introduce clear pricing guidance and pricing controls (e.g., approvals for price exceptions) to ensure pricing consistency. Even better would then be to align your sales incentives and disincentives to drive the desired pricing behavior in the longer run.

4. Be strategic when increasing prices

Increase prices by the strategic role of each product.

Instead of applying uniform and ad hoc price increases, increase prices by the strategic role of each product or product category in your portfolio.

Product roles in a portfolio include leader, niche, commodity, and filler.

- Leader products drive brand identity and revenue.

- Niche products meet specific needs and command higher margins.

- Commodity products broadly target customers (low-margin, high-volume play).

- Filler products complement the portfolio and support cross-selling.

Typically, filler products should have the highest percentage price increases, followed by niche and commodity products. Leader products should have the smallest price increases.

5. Monetize customer conveniences

Charge for value-added services.

To further improve margins and control your pricing, charge for value-add services that make your customers’ purchasing experience easier and smoother. Customers who value these services will pay more to receive them.

For example, consider charging for credit card fees, local pickup, rush orders, small orders, single shipments for large orders, and when shipping and handling non-standard or specialty products. These charges will improve your margins by covering costs associated with providing customer conveniences. Consider baking some of these costs into your pricing instead of itemizing them on invoices to prevent a nickel-and-diming pricing approach which can annoy customers.

From a pricing control perspective, sales reps can use value-add services fees as negotiation levers to keep your product pricing untouched. For example, a sales rep could waive the credit card fee, which would lower the invoice amount, instead of discounting the product price. This means that your product price point remains intact for future reference when new orders are placed or the customer renews the contract.

Additional Tips

These are not the only methods to pursue to optimize pricing and realize benefits. Other quick wins include regional price differentiation, pricing to support product bundles and cross-selling, omnichannel pricing consistency, discount-level and discount type optimization, customer profitability analysis, and SKU rationalization.

As you adopt these strategies and begin to see initial successes, I recommend building on them by adopting a strategic, value-based approach to pricing. Engage cross-functional teams to manage pricing decisions, create a system of pricing governance, and continuously analyze performance metrics. With these steps, you’ll be well on your way to sustained pricing excellence and a stronger competitive edge.

Find pricing experts now.

Get StartedMeet the Author

Mohammed Zakir is principal and founder of Acustrategy, a pricing consultancy that works with clients in manufacturing, tech, and many other sectors. Mohammed has 25+ years of pricing experience and used to work in Boston for Simon Kucher and Charles River Associates before he launched Acustrategy in 2008. He has a BA in Economics and Mathematics from Middlebury and an MBA from MIT and is a leading pricing consultant on Catalant.

Want to work directly with Mohammed? Contact us to learn how.