Transformation is the Engine to Drive Real-Time Strategy Execution

Transformation is the Engine to Drive Real-Time Strategy Execution

The thousands of projects on our platform tell a story about what’s happening in business today. Every month, we analyze project data and bring you a highlight of relevant market trends. This month, we dive into the interplay between strategic planning and transformation.

- Strategic planning and transformation are tightly intertwined.

- Transformation is the engine to drive real-time strategy execution.

- Consulting 2.0 eliminates capability gaps, as transformation often requires new skills.

Strategic planning has been a linear process, typically developed annually. Business transformation, on the other hand, is designed to be dynamic and respond to market changes. Over time, it has become harder to separate the two as companies move to more real-time strategic planning.

Strategic planning is no longer an annual process

With the rise of digital technologies and need for continuous innovation, strategic planning and business transformation have evolved to become more iterative, adaptive, and integrated.

To execute well in the face of changing market dynamics and an uncertain environment, experts recommend strategic flexibility — planning for shorter time horizons, adopting more agile ways of working and bringing alternatives to the table. Transformation has shifted from a one-time, named initiative to a capability that enables continuous change. Speed and flexibility become the most important attributes to realizing successful outcomes.

Companies that rely on long-range waterfall planning cycles move too slowly to make necessary pivots. In an environment with a high degree of uncertainty, the strategic planning process and the transformation office (the execution arm of major, cross-functional priorities) need to be closer than ever to prioritize initiatives and provide a feedback loop to the strategy. It’s quite clear to us that companies are beginning to move strategy from an annual process to an always-on, continuous capability, informed by the learnings of transformation efforts and adapting as such.

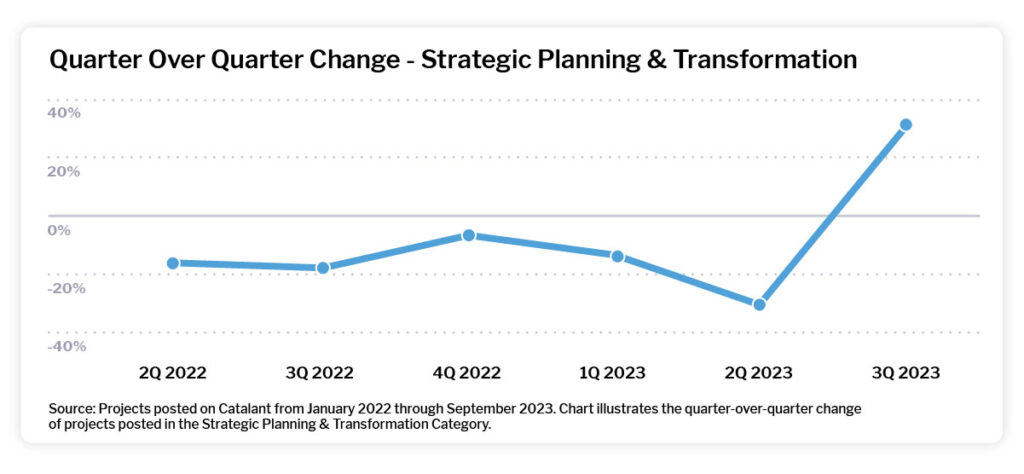

The data from our platform, based primarily on projects from the Fortune 1000, consulting firms, and private equity firms and their respective portfolio companies, reveals a sharp increase in strategic planning and transformation projects over the recent quarter, following a consecutive three-quarter decline.

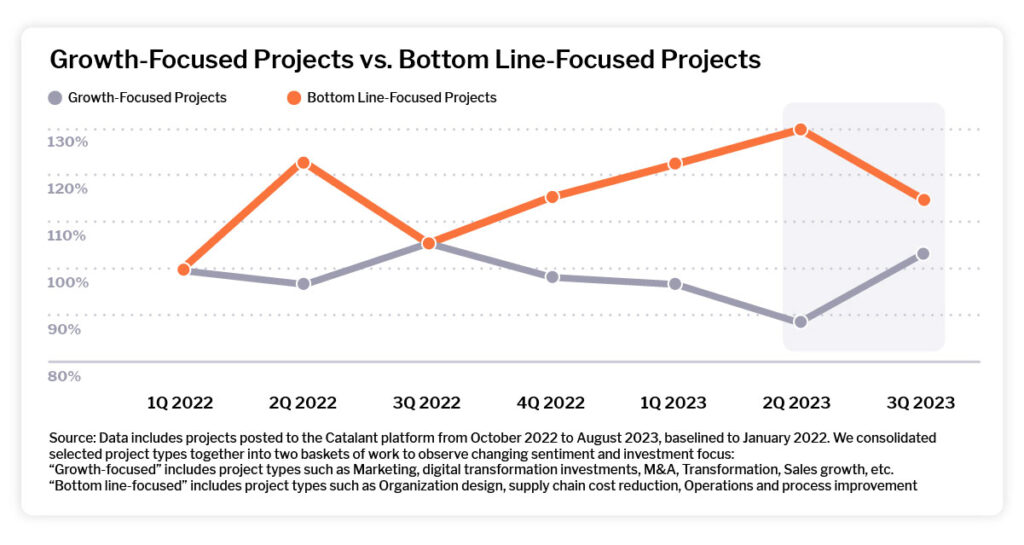

Why? As we noted last month, our clients appear to be making a cautious rotation back to growth. Over the period from 4Q 2022 to 2Q 2023, we saw a huge concentration of bottom-line-focused projects on the platform. Much of this bottom-line work was functional in nature. Driving both growth and bottom-line efforts in an uncertain environment puts more stress on how strategy is set and executed.

What did those bottom-line projects look like? Cost efficiency, cost control, and a need to make operational improvements that were by and large ignored in the heydays of 2021 and beginning of 2022. There were also implications to human capital, with companies remaining conscious of avoiding overhiring, a costly mistake many made in 2021.

Now, we’re seeing a shift towards growth, albeit with a far more deliberate and iterative approach, as companies recognize their bottom line efforts are well in place and they need to find ways to drive topline. It’s time for considered growth, enabled by the continuous evolution of strategy.

- One example that’s emblematic of what we’re seeing is a large CPG client is reestablishing their growth office to focus on transformation and growth through continuous iteration of the strategy. This allows them to focus on targeted transformation while partnering with key teams within business units but without slowing down execution against its core operations.

- We’re also hearing (and seeing in our platform project data) a greater focus on improving forecasting so that companies can better understand where revenue will end up and the drivers of it and invest ahead in new transformation efforts with confidence the revenue will come in. This has become especially challenging as the conversion rate from deals booked to revenue recognized has dropped within most organizations, making forecasting especially hard.

The chart below illustrates the prolonged period of bottom-line focus and the emergence of a new growth period at the end of 3Q 2023.

Transformation driving real-time strategy

If the past three years have taught us anything, it’s that a good strategy can become out of date quickly. Think back to where we were just a year ago and how much has changed in the market. Companies can’t rely on an annual strategy-setting process anymore.

The Transformation Office is the key to enabling a company to adjust strategy more real-time. An organization focused on executing and iterating against strategic objectives provides real-time learnings and a lever to more quickly adapt to what’s happening in the market. It’s why we’re seeing a real-time emergence of Transformation going from a special initiative-focused organization to the execution arm of strategy, specifically on efforts that are cross-functional or in some way new to the business.

What’s the key to success? As with many cases, it’s all about the people.

In analyzing the hundreds of transformation projects companies have used our platform to execute, a clear shape emerges of the type of people needed to drive real-time transformation and inform changes to strategy:

Experienced business professionals who have a blend of management consulting experience and industry operating experience.

We dove into that project data to examine the profile of the independent consultants who work on these projects.

- Nearly 50% have both professional industry experience in the client’s industry and former management consulting experience.

- 13% have experience in the relevant industry but lack previous management consulting experience.

- About 40% have management consulting experience, and while nearly all had completed projects in the client’s industry, they hadn’t held non-consulting roles in the related industry.

- Across the independent consultants, the average years of work experience was 18.5, with a low of 8, a high of 35, and a median of 17 years.

- In all cases, clients were in search of someone (or a team of people) who had solved their problem before.

For further reading, download our comprehensive guide: Strategic Planning in an Era of Uncertainty

Consulting 2.0 eliminates capability gaps

To actualize “always-on” strategic planning and transformation, companies need to operate more flexibly. One strategy to achieve that is by doing what Joe Fuller, HBS professor, and co-lead of the Managing the Future of Work project, calls “hiring to the trough and variabilizing to the peaks.”

Instead of hiring to anticipate full future capacity and capability, it’s much easier to narrow in on your core capability and augment with non-permanent talent in scenarios outside of your core capability.

This concept works very well to support “always-on” strategic planning and transformation because the profile of the people needed to drive real-time transformation and inform changes to strategy are highly experienced (and expensive). Hiring senior business professionals like these on a temporary basis is a cost-effective way to get the experience needed with minimal financial outlay.

Ten years ago we saw the need for companies to have this type of talent source to tap into when they needed to find someone who had solved a particular complex problem before.

Today, we’ve coined the term “Consulting 2.0” to reflect what this source has become – a flexible, fit-to-purpose solution that is right-sized and transparently priced. Much like traditional management consulting was the go-to solution for solving complex business problems, Consulting 2.0 offers the requisite level of expertise, but with the flexibility and speed demanded from today’s business environment that traditional consulting lacks.