The Ultimate Guide to Finance and Accounting

Finance and accounting can help you better understand your incoming and outcoming cash flow and make more informed business decisions.

While finance and accounting are both closely related to the administration and management of an organization’s assets, they have key differences. It’s important to understand both in order to support your company’s financial health.

Below we’ll cover the differences between finance and accounting, their importance, as well as their relationship to other fields like Financial Planning and Analysis (FPA).

Difference Between Finance and Accounting

Finance is a broader term that refers to how an individual or organization generates, uses, and manages money. Accounting refers more narrowly to the process of recording, classifying, interpreting, and presenting financial information about an individual or organization.

Whereas finance typically involves activities like investing, borrowing, lending, budgeting, and forecasting, accounting involves recording transactions, processing accounts payable and receivable, collecting financial information, reconciling cash accounts, compiling reports, and analyzing and summarizing financial performance.

The goal of finance is to analyze financial data to identify areas of concern or opportunity, forecast trends, and create or adapt growth strategies. The goal of accounting is to provide an accurate snapshot or scorecard of a party’s financial position at a given point in time, often through financial statements like balance sheets, cash flow statements, and income statements.

In other words, while finance looks to the bigger picture in the future, accounting looks at day-to-day operations in the past.

The table below clearly breaks down these differences, and others, between finance and accounting.

How Finance and Accounting Work Together

While they are different, finance and accounting work together to ensure a company can maintain and scale its operations.

Accounting is the process of recording and reporting financial information from business transactions. Finance uses this information to determine and improve the efficiency and effectiveness of its operations.

For example, finance uses accounting information to create working capital analyses and budgets. The purpose of these analyses is to ensure that a business has enough cash to operate, whereas budgets are designed to plan, allocate, and disburse monetary resources. While finance is responsible for creating these analyses and budgets and ensuring the company maintains the budget, accounting is responsible for continuously supplying the information needed to create them.

Finance and accounting teams typically work together to present the financial statements to management as well.

Importance of Finance and Accounting

Together, finance and accounting play a crucial role in improving decision-making and maintaining the financial health of an organization. Let’s take a closer look at their key benefits below.

1. Developing a finance strategy.

Finance and accounting involve the creation and analysis of detailed records of a company’s finances. This is essential for understanding your income and expenditure, which can help you develop a finance strategy to optimize your business operations. For example, you may discover which department of your company is the most cost-efficient by tracking what percentage of the company’s financial resources each department consumes. This will help you better allocate your resources and inform decisions around hiring and other expenses.

In short, both finance and accounting can help an organization determine what to spend, where to spend, and when to spend.

2. Meeting laws and regulations.

Accounting can help keep your company in compliance with state and federal laws and regulations. Without it, you may not pay the right amount of sales or income tax, for example. Or you may not properly address pension funds or another liability. You may also overlook priorities like making facility improvements to comply with safety laws.

Additionally, having accurate and detailed financial records is important if your company ever comes under legal scrutiny.

3. Analyzing performance.

By keeping your company’s financial records, you can see how and where you used capital and analyze any areas for improvement. For example, after completing a profitability and cost analysis, you may be able to make data-driven recommendations to downsize some operations and invest in others that are more cost-efficient to increase your bottom line.

Finance and accounting teams may compare a company’s financial information from different historical periods, or compare it to the financial information of other companies in the same industry to better understand its performance.

4. Communicating with stakeholders.

Finance and accounting are also important for providing investors, management, and other entities with a clear picture of your company’s finances. By evaluating the record of their organization’s income, expenditure, asset liabilities, internal stakeholders can make better decisions about investment, resource allocation, and more.

Entities like lending institutions and publicly traded firms also use these financial statements. Lending institutions do so to evaluate an organization’s creditworthiness. Publicly-traded firms need to file these statements with the Securities and Exchange Commission.

5. Deterring fraud and theft.

Continuously monitoring and analyzing a company’s financial transactions can also reduce the chances of fraud and theft taking place. Accounting principles, in particular, can create a system of checks and balances that verify the actions of employees and holds them accountable. For example, there may be an independent third party that reviews a company’s books and ensures that the transactions recorded line up with how the receipts and deposits are handled.

Now that we have a better understanding of the differences between and importance of finance and accounting, let’s take a closer look at two subdisciplines: FP&A and financial accounting.

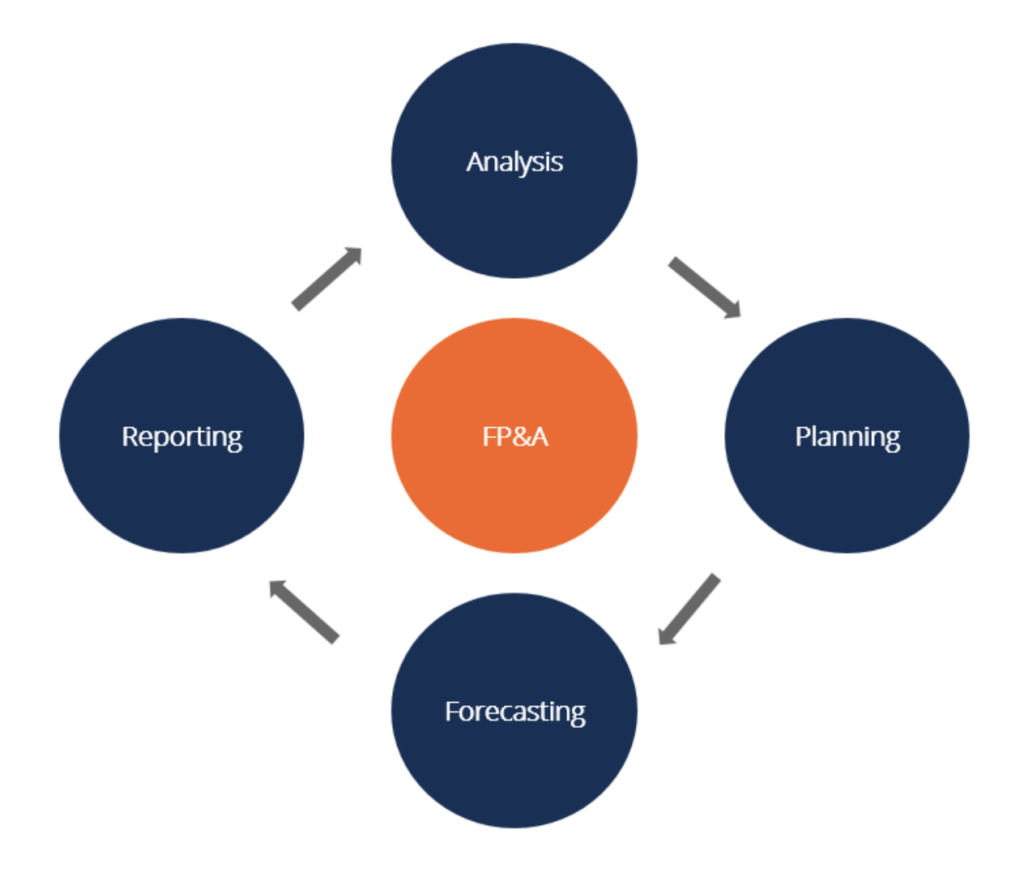

What is FP&A?

FP&A stands for Financial Planning and Analysis. It refers to a set of activities that support a company’s decision-making and overall financial health. These activities typically include planning, budgeting, forecasting, and reporting.

While accounting is in charge of recording a company’s financial activities, FP&A is responsible for examining, analyzing, and evaluating those activities in order to map out its financial future. FP&A has a broad scope, overseeing not only financial statements but income, expenses, taxes, capital expenditures, and investments.

More specifically, FP&A might involve:

- Assessing and monitoring the company’s overall financial performance

- Providing financial analysis and advice to executives

- Identifying which products have the highest profit margin

- Anticipating economic and business trends that may impact the company’s financial health and investments

- Predicting the impact of potential decisions on cash flow

- Building financial models and forecasts of the company’s financial future

- Creating integrated financial plans

- Collaborating with departments to prepare and consolidate budgets into one corporate budget

- Identifying and assessing new revenue opportunities and risk

- Calculating key financial ratios like debt to equity ratio, current ratio, and interest coverage ratio

FP&A Example

Here’s an example of how a financial planning and analysis consultant can help a business. Imagine a private equity-backed retail business is moving from an annual budgeting model to a monthly model. An FP&A consultant can help them and each individual department successfully shift to the new model and re-forecast their budget for the next year using historical results as well as projections for the remaining year.

Financial Accounting

Financial accounting is a specific branch of accounting that helps an organization keep track of its financial transactions. It involves recording, summarizing, and reporting all the transactions resulting from business operations over a period of time.

Its purpose is to prepare a company’s financial statements to reflect a specific period of time. The most common financial statements are:

- Income statement: Also known as a profit and loss statement, an income statement summarizes all expenses and income over a specific period of time, such as a quarter or a year.

- Balance sheet: A balance sheet is a statement of assets, liabilities, and equity at the end of a specific period of time known as the accounting period.

- Cash flow statement: A cash flow statement shows the actual flow of cash into and out of a company over a specific period of time (the accounting period).

- Statement of shareholders’ equity: The statement of shareholders’ equity that shows changes in ownership interest over time. It measures the difference between total assets and total liabilities usually on a monthly, quarterly, or annual basis.

Preparing these financial statements is important for two reasons. First, it can help a company decide how to best allocate its resources. Second, it can help a company communicate its revenues, expenses, assets, liabilities, and equity to creditors, investors, and third parties. This financial data can encourage parties to partner with your company.

The financial statements generated by financial accounting must conform to a series of accounting standards and legal requirements. In the United States, these financial accounting and reporting standards are established by the Financial Accounting Standards Board (FASB) and are known as generally accepted accounting principles. Outside of the U.S., there are financial accounting and reporting standards established by the International Accounting Standards Board (IASB).

Accounting and Taxation

Accounting is a broad discipline related to tracking and organizing a company’s financial data. This includes reporting its income and expenditures as well as determining its tax liability.

It’s essential that accountants ensure tax filings are accurate and legally compliant. They can also help their clients legally increase their tax savings. For example, there are accounting methods like deferring income or accelerating deductions that can reduce an individual’s or business’s taxable income.

Additionally, accountants can analyze tax-related business decisions and any other issues related to taxes. For example, they may help a business decide where to open new office locations based on the impact of corporate income and gross receipts taxes.

Accountants that specialize in helping individuals and businesses prepare and file tax returns are commonly referred to as tax accountants.

Like financial accounting, tax accounting is a subsector of accounting. It focuses solely on financial transactions that affect a party’s tax burden. Its ultimate purpose is to be able to track funds (both that are coming in as well as going out) associated with individuals and entities.

While financial accounting conforms to generally accepted accounting principles, tax accounting conforms to another set of principles established by the Internal Revenue Service. The IRS ensures that tax accounting professionals and taxpayers adhere to all associated tax laws. Some of these laws require the use of specific documents and forms to properly submit tax information.

Finance Strategy

A finance strategy combines financial and strategic planning to assess current resources, costs, and budgets and aligns them with the company’s overall objectives. This will require you to evaluate your historical spend as well. The best finance strategies can help an organization grow and innovate even during times of change. A finance strategy may impact the finance function specifically or the organization as a whole as well as policies, processes, and technologies used.

It typically consists of a few elements, including the ones detailed below.

1. Managing Cash Flow

A crucial part of any corporate finance strategy is detailing how cash will be used by the business. How much must be dedicated to making payroll? How will other expenses be paid? What amount should be in reserves at any given time?

Having these details laid out will simplify financial decisions like when to write a check or when to access a line of credit for certain purchases or projects. It can also help you plan ahead to avoid delays in initiatives due to financing issues.

2. Planning for Purchases

Every finance strategy should detail how purchases are made through the business such as which should be made with cash, which with a credit card, and which with a line of credit. Also, ask whether there is a certain amount that will require approval by a manager or by the board. It should also detail when payments are made. For example, if one of your vendors offers 30-day terms, plan to make a payment at the end of each month.

3. Collecting Outstanding Bills

In addition to detailing accounts payable, your financial strategy should also detail how to manage accounts receivable. Are customers required to put down a deposit for products and services? What happens if customers are overdue on payments? Will they be assigned to a dedicated internal team or sent to an outside agency? Will late fees be charged? These are just a few questions that a financial strategy can answer.

4. Making Investments

A finance strategy should specify the percentage of money invested in high-risk portfolios versus lower-risk portfolios and offer some guidance to management on making investments. For example, approval may be required to make changes to current investments or to liquidate investments to cover business necessities.

5. Budgeting and Forecasting

Understanding how much money you’ve spent and earned in the past is an important input when creating a finance strategy — but looking at historical data is not enough. It’s also essential that you think about and secure your company’s financial future by proactively budgeting and forecasting.

A finance strategy should be based on what gross profits and operational expenses currently are and are projected to become. Operational expenses include payroll, marketing, meals, travel, utilities, and more. This can help you set an accurate budget that will help you set guidelines for managing your spending, make better financial decisions, and ultimately maximize your bottom line.

Accounting Strategy

An accounting strategy sets guidelines for reporting, evaluating, and communicating financial data. This is important for ensuring financial data is reliable, which can help management confidently make decisions using this data and avoid bigger issues related to improper taxation details or disorganized bookkeeping. An accounting strategy is also important for ensuring that management and other stakeholders understand the facts behind the numbers.

Below are a few common aspects of an accounting strategy.

1. Tracking Cash Flow

As discussed above, accounting is important to any business because it provides detailed records of how cash is earned and spent. An accounting strategy should provide guidelines for the actual tracking process. Will each expense be categorized and assigned a label? Will you use accounting software to help automate the process? These are just a few questions that an accounting strategy can answer.

2. Securing Account Records

Since account records contain sensitive information about your company’s finances, they must be stored and secured properly. If you have paper records, how are you protecting them from theft or damage? If you have digital records, how are you storing them securely? These records should also be backed up periodically in case of server failures or other technical glitches. An accounting strategy should detail this process as well.

3. Ensuring Compliance with Laws and Regulations

One of the biggest reasons that accounting is so important to businesses is that it helps you comply with laws and regulations. To do so, your financial reporting must be accurate. That’s why an accounting strategy must detail clear processes and procedures for recording and verifying revenues, expenses, assets, and liabilities.

How Finance and Accounting can Help your Business Grow

Finance and accounting help you better administer and manage your organization’s assets. By collecting and analyzing your organization’s financial information, you can not only meet state and federal laws and regulations and tax obligations, but you can also better understand your financial performance to make more informed strategic decisions to maintain and grow your business.

Ready to find the right independent consultant for your financial and accounting needs?

Let’s TalkRelated Articles

Share Article