Building Strategic Resiliency: 5 Learnings from the Executive Strategy Session

In today’s business climate, it is more important than ever for corporations, private equity firms, and consulting firms to build strategic resiliency. To be successful, leaders must be agile and forward-thinking, and they must also be able to drive results through intellectual honesty.

At Catalant’s Spring Executive Strategy Session, over 60 SVP and C-level business strategists — including Catalant customers, advisors, and partners — came together to discuss these issues and more. Several key takeaways from the event are outlined below.

1. Growth Through Portfolio Transformation

Raj Ratnakar SVP, Chief Strategy Officer of DuPont

Raj Ratnakar, DuPont’s SVP, Chief Strategy Officer is well-versed in how to effectively manage and execute complex transformations and drive portfolio strategy and growth amid economic uncertainty.

Based on extensive strategic leadership experience at DuPont, Danaher, Fortive, and TE Connectivity, Raj explains there’s an overarching framework for effective portfolio strategy and transformation to help guide today’s leaders.

- Determine why you’re conducting portfolio transformation. “Answer the question, ‘What do you want to be when you grow up?’ to identify and define the vision of the company.”

- Study the markets to determine why you need the transformation and communicate the vision to all stakeholders. Stakeholders need to be aligned on the vision and reasoning behind the transformation, including the CEO, leadership team, and the Board. You may need to bring in outside perspectives, such as expertise that may not exist internally, to help understand new markets.

- Maintain optionality. When it comes to strategy and portfolio transformation, every business model is unique and has different needs. Some markets may be more complex than others to infiltrate. That’s why keeping a degree of freedom in portfolio transformation is essential. For example, avoid thinking about your portfolio strategy only in terms of business cycles — this rigidity typically doesn’t work in rolling economic times. And don’t forget, there are a multitude of tools in the kit: divestiture, share buy back, etc. It’s not just about acquisition. Sometimes spinning off a business and giving it a new frame results in better value extraction.

- Leverage the right talent and be patient. Business model transformation often drives a need for talent transformation. Identify and leverage the right talent and expertise to manage your portfolio transformation and strategy based on relevant experience. Don’t put a precise timeline on a transformation ahead of kick-off — it’s rarely a beneficial way to spend your time since every transformation is unique. This combination of the right talent and patience will make your funnel resilient.

2. Qualities of Today’s CEO

Richard Steele, Partner, McKinsey & Co.

During his talk, Richard Steele, Partner at McKinsey co-leading the change practice, confirms what we already know: leadership is essential. But the degree to which good leadership matters may not be as obvious — especially when transformative change is the norm.

Richard shared original McKinsey research and insight that defines the various characteristics and skills today’s leaders must have. And the proof is in the profits. Their research reveals that the highest-performing CEOs deliver an excess of $3 trillion in value creation and see 30 times more economic profit. And the biggest driver moving the needle? Bold moves. Making bold moves resulted in a two-to-six times higher probability of being in the top.

So what do these CEOs have in common? Here are the highlights:

- Prioritize creativity: Today’s most outstanding CEOs and leaders are creative thinkers who know how to get the most out of the people they work with, including the Board, and when to engage externally. They spend a lot of time in one-on-ones with their direct reports and collectively to establish a strong foundation for leadership.

- Manage change by containing and “role modeling” it: To best manage change, work on containing it. Then have leaders role model the change and focus on execution.

- Use the Board: Use the right stakeholders and the Board to their full advantage — you’ll get the most out of your partnership if you view them as assets.

- Be an architect: Be an architect, not just a planner — think long term about how and for whom you create value.

- Be vulnerable: You must be human for direct reports and their teams to feel psychologically safe enough to be creative and execute their roles. Show vulnerability as a leader.

Read more from McKinsey on how a dual focus on developing people and managing them well results in better performance.

3. The Power of Intellectual Honesty and Radical Candor with Heart

Jennifer Morgan, Global Head of Portfolio Operations, Blackstone

Every company is focused on creating operational efficiencies. And no matter the economic environment, growth still matters. So how do you actually do more with less? The secret, and the one factor you can control: great people. You can control making sure that you have and grow great people, and it starts with great leadership.

Jennifer Morgan, Blackstone’s Global Head of Portfolio Operations and former Co-CEO of SAP, oversees about 250 portfolio companies totalling 750,000 employees. With a focus on companies with tailwinds and big runway to achieve even greater things, their role is not to do the work in a portfolio company, but rather figure out what the company needs, and help execute. This comes through adding great talent and bringing a depth of experience to help accelerate and amplify. She believes that intellectual honesty and radical candor with heart are critical in achieving that success.

- Intellectual honesty is a crucial component to leading through uncertain times. During Jennifer’s experience being co-CEO at SAP, she perfected the art of encouraging a large organization to let down guards and operate without a sense of fear.

- At Blackstone, she has instilled the same culture of intellectual honesty which allows the team to ask, “Can we really do all of this at once?”, giving them a sharper degree of focus in prioritizing and sequencing work appropriately.

- When you take the fear out of an environment and create a culture of bringing challenges to the table before they become full blown problems, you can experience radical candor – with heart. Radical candor with heart encourages people to speak their truth with empathy and compassion. It enables direct reports to share their problems, offer feedback, and be honest about what is and isn’t working.

- Jennifer uses radical honesty with heart to maintain three dimensions of leadership at Blackstone: listening, learning, and taking action. As a result, she has a better understanding of what’s going on financially, real-time operating metrics and data, and sentiment about what’s happening across the company.

4. How Portfolio Managers Can Drive Value Today

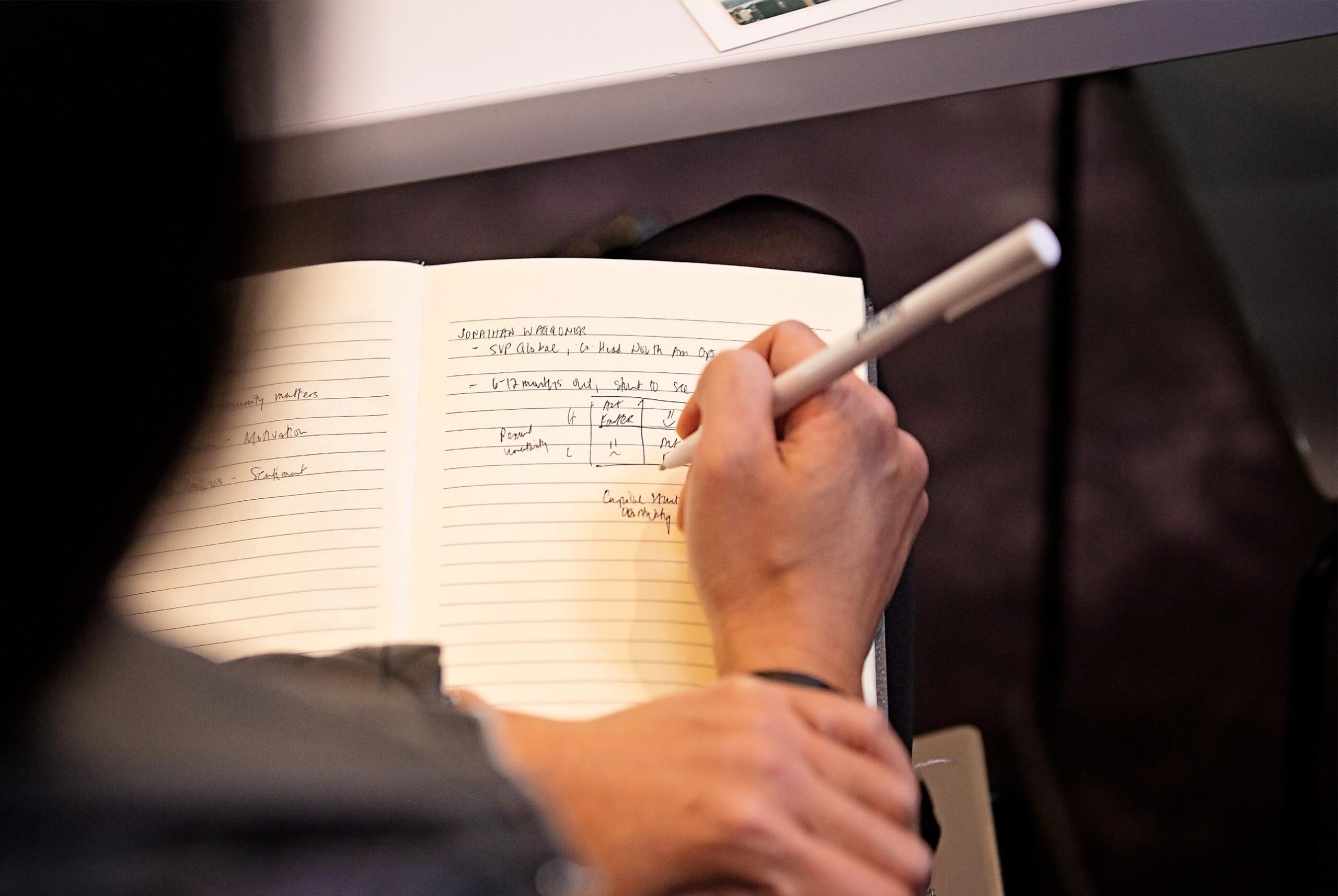

Jonathan Waggoner, Managing Director, Co-Head North America Operations at SVPGlobal

Viewing today’s market through a credit lens instead of an equity lens gives you a new perspective on trying to figure out what’s happening. Jonathan Waggoner’s firm, SVPGlobal, focuses on distressed debt, special situations and private equity opportunities. He provided an insightful view into how his firm is approaching today’s uncertain market.

SVPGlobal sees the world through trades, monitoring hundreds of thousands of them. And right now, the signals are tricky. As Jonathan said, “it’s hard to drive with a dirty windshield.” Market signals aren’t correlating like they used to, and typical proxy indicators aren’t revealing much, let alone offering guidance on what actions to take next.

For example, the typical indicator of a recession in the credit market is when the high-yield bond spread goes above 800 basis points. However, the high-yield bond spread has not risen above 500 basis points, yet there is a recession happening in the credit market. One reason? After a long period of high quality debt, there’s been a sharp correction. Although many are predicting shallow recession, soft landing, there will inevitably be some hard landings for some really good companies.

The advice offered was this: think a little more aggressively about cost in your own portfolios, and act fast (and in some cases, act faster).

The problem is, many companies don’t have the team necessary to navigate the current context. Many employees were hired when growth was paramount, and may not be familiar with previous era’s playbooks that are being dusted off and put into play today which focus on cost efficiency and working capital. Can your current team systematically transform a business from “the middle of the P&L?” Meaning, a focus on profitability, gross margin, supply chain, and turning that into working capital. Given these challenges, here are a few tips Jonathan offered:

- There’s still a war on talent. But the shape of talent needs is changing. The market for an experienced 30-year veteran operator is hotter than ever before. Consider bringing back “the old guard.” In some cases, SVPGloabl’s companies are bringing executives who worked at the company many years ago back as consultants to augment current operators’ skill sets because of their experience leading through a cost management context.

- Speed is essential. Remember the “act fast, and in some cases act faster” advice from above? Stop waiting on perfection, and move faster by using variable resources like Catalant’s. Set up operating processes that allow you to bring in external, interim talent — fast.

- Be maniacally focused on flexibility. Accept the fact that you’ll make mistakes in environments, like we’re in now, which have a high degree of uncertainty. You’ll likely overcorrect, but oftentimes, you won’t know where you overcorrected until it’s too late. Variabilize pools of labor to absorb up- and down-market impacts. You still need to be thinking about growth, but consider approaching the task with leaner, smaller, and more variable teams.

5. How Future-Forward Companies Operate Today

Pat Petitti, CEO and Co-founder of Catalant Technologies

Amid substantial and continuous change, corporations are looking for ways to adapt how they get work done. Companies need to operate with speed and intention when facing both opportunities and challenges — they also need the right blend of talent. Pat Petitti, CEO of Catalant Technologies, knows this better than anyone else.

Catalant’s Expert Marketplace — which offers corporations, private equity firms, and consulting firms access to over 80,000 independent consultants who can help fulfill a blended workforce — has a plethora of data that tells a story about strategic decisions being made by leadership teams today.

More and more companies are managing their talent portfolio as you’d manage an investment portfolio – with balance and mix. As Pat shared, global Fortune 100 executives have recognized the benefits of increased business agility, and a blended workforce aids in achieving that degree of flexibility.

Here are some takeaways:

- Remote work remains higher than it was pre-COVID, but we are seeing a shift in the desired location of where work happens. Through COVID-19 years, we saw an inevitable spike in remote project work. Since the peak in January 2021, we’ve seen a shift downward, with a preference toward more hybrid and on-site work. While 80% of the work remains remote-first, much like what we’re seeing in the FTE world, clients are increasingly bringing independent consultants back on site for at least a kickoff, mid-point check in, and final deliverable.

- Strategic resource allocation is top of mind. Some organization design projects are focused on cost reduction, however, we’re seeing a consistently emerging theme of companies needing to redesign their organization to match the go-forward strategy, and needs to create more flexible organizational structures.

- Digital strategy, transformation, and technology are priorities for forward-thinking companies. While digital advancements accelerated through the last decade, potentially hitting a saturation point, we may be entering a new era, one that is driving the need for new technology innovations. Digital Transformation & Technology projects remain a steady chunk of work done on our platform, and when we double click into that work, we see that these projects are disproportionately driven by our largest customers. While across the platform, 10% of all project work is initiated by Fortune 500 companies, in the digital transformation category, upwards of 25% of the projects are driven by these large companies.

- M&A activity is increasing again. We are seeing indications of an increase in M&A strategy work, across both corporate and PE firms. We’re also seeing market research pick up in certain areas — there’s a sense at some PE firms that deal activity will pick up mid to late summer, and when it does it will be a bit of a tidal wave. Many of those firms are trying to get ahead, and we’re seeing a good number start to look at new industries firms previously didn’t focus on.

- Finance projects are sometimes prioritized over strategic planning projects. Historically, we see very strong correlation between these two project categories, which makes sense, oftentimes companies are going through planning processes in parallel with financial transformation. However, recent data revealed three key times when the trend in these two project categories diverged and finance projects took the priority: Spring 2020 when COVID-19 first emerged; Fall 2020 around the presidential election; and now, in early 2023, a period where there is far more focus on operational efficiency.

The Executive Strategy Session was an amazing opportunity to learn more about some of the most pressing issues facing business leaders today. We hope to see you at the next Executive Strategy Session this Fall.